by Jeff Van West

Rationalization and denial are key skills for any airplane owner. How else to justify the cost of owning and operating an airplane? On rare occasions, a GA airplane beats the airlines in dollars and hours, but we usually accept that were paying extra for the privilege of flight. We bask in the glory when it works in our favor and ignore the numbers when we make that unexpected overnight in the Airport Best Western.

None of this means we cant or shouldnt look for the best ownership deal. One option is owning a share of a GA airplane the way Warren Buffet owns pieces of various G-Vs: fractional ownership. We last looked at fractionals in 2002 (see Aviation Consumer, June 2002) and were cautious but optimistic. With four more years of field experience, hows this concept doing? Is it a realistic ownership option?

Lets be clear on whos a good candidate for fractional ownership of a Cirrus SR22. If you fly fewer than 50 hours per year, forget it. No amount of massaging the numbers will make owning any flying object make sense. Your best bet is renting, a club or partnership or taking up another hobby.

If you fly more than 250 hours per year in the same model aircraft, then sole ownership is attractive. Not only does it make economic sense, but you can leave your flight bags and headsets in the airplane rather than schlepping that stuff every time you fly. If your flying involves taking the airplane for weeks at a time, or going up to the country house every weekend, you need a partnership with similar users who fly different days than you do rather than a fractional.

That leaves pilots flying 50 to 250 hours a year, usually on trips of one to four days. Looking back on several years of two GA fractionals servicing this group, we can say with confidence that the system works, with a few caveats. First, you really must have a burning need for a new airplane. The advent of glass cockpits and new technology-TAWS, traffic awareness, datalink weather and, yes, airframe parachutes-has widened the gulf between what you get in an older airframe and what you get in a new one. You can update an old airframe, but it takes time, energy and money to put the pieces together.

That brings up point two: Fractionals are best for show-up-and-fly pilots, not tinkerers. The number one benefit we heard from fractional owners was the pleasure of not dealing with the details of ownership. When they show up, the airplane is pulled out, fueled, its multiple databases are current and its ready to go. If a squawk pops up during the flight, they write it up or call a phone number and someone else makes the problem go away. Dealing with the squawk that pops up before a flight leads to advantage number three of fractionals: the potential for better availability. Whether fractionals could deliver on the promise of availability was the big question when they first appeared. How can eight owners fly one airplane without conflict?

Our research with the two big players in GA fractionals-OurPLANE (OP) and Air Shares Elite (ASE) – as we’ll as other small operations, show that with three airplanes to shuffle around, there are virtually no conflicts, meaning maybe once a year you cant schedule an airplane. If four airplanes are in the mix, there are no conflicts.

With two airplanes and 10 to 12 owners, conflicts are rare, but happen once a month or so. When conflicts do happen, fractional management can arbitrate the conflict. Owners from both ASE and OP report that their respective flight ops do an excellent job working out problems when possible.With only one airplane available, its a crap shoot. The owners-to-airplane ratio and relationship is, in our opinion, the most fundamental distinction between ASE and OP and a good place to look at the difference between the two.

The Big Pond Approach

David Lee, President of Air Shares Elite, is clear about where ASE will and wont set up shop. We need a one million MSA (metropolitan statistical area). This means one million people within 30 miles of the airport. We believe we can sell a half share per 1000 pilots per year. With one million people, thats 10,000 pilots, which is five shares [per year]. There are only 50 one million MSAs in the U.S. and ASE is already in 12 of them. If you live in Burlington, Vermont, ASE might be able to hook you up with other pilots in your area who have called them (ASE gets five or six inquiries a day), but they wont be offering you an airplane share.

If you are in one of those big markets, however, and ASE decides to commit, they do so with gusto. ASE will set up a local office and enter the market with a minimum of two airplanes. Theyll only start selling shares after theyve committed. They can sell up to 50 percent of these two airplanes before they guarantee bringing on a third airplane. Theyll sell up to 75 percent of three airplanes before they bring in a fourth. With four airplanes, ASE can sell out at eight shares per airplane-thats four airplanes with 32 owners.

When you buy in, your name goes on the airplane title, so you own a piece of a particular airplane. A one-eighth share of a loaded SR22 GTS through ASE costs about $67,000. Thats your equity share to own, claim depreciation on your taxes and sell if you wish.

There are four ways to get out of the partnership. The first 60 days is a testing period. Either you or ASE can choose to terminate the relationship and all the money is refunded, minus any accrued flight time. After the initial period, you can sell your share to anyone who meets the ASE pilot criteria for any price you choose. ASE can help you sell it for a 7 percent broker fee, if you wish. If you cant wait for a buyer, ASE will buy back the share at Vref wholesale value, which is usually about 85 percent of market.The aircraft are sold and replaced with new every four years, so if your airplane is coming up for sale, you get one-eighth of the net proceeds of the sale and youre done. Its your option to reinvest that money in a share of a new airplane.

Pricing for ASE varies from region to region. In New York, the monthly costs are $840 and the hourly rate is $80. Thats $215 per hour wet if you fly your 1/8 share worth of 75 hours per year. If you fly more than that, you can buy more than a 1/8 share. Packages range from 75 to 200 hours of use per year.

In New England, there’s no hourly rate. You pay $1350 per month to fly 75 hours per year, period. Thats $216 per hour if you fly all 75 hours. Buy 200 hours for $3200 per month and its $192 per hour. This is an experiment in the New England region in response to what Regional Director Brad Rosse jokingly called cheap-screw old Yankees who like knowing exactly what theyre going to pay. This fits the fractional philosophy, however. About 40 percent of ASEs clients owned their own airplane solely or in partnership before ASE. Interestingly, some still own another airplane but use the ASE Cirrus for business or travel under 500 miles.

What if you fly more than your 75 hours? You don’t, says Rosse with a smile. Actually, we can make a small allowance, but its at a high hourly rate, like $350 per hour. If you fly more than your allotted hours, ASE wants you to upgrade your ownership to match. If you fly under your allotted hours, you can roll up to 20 percent of them to the next year. There are no minimum flight hours, but ASE limits you to 21 overnights for a 75-hour share to prevent too many extended trips.

An hourly charge of $216 sounds like a lot, but when compared to a rental, consider the aircraft quality, even you can even find a comparable rental. If youre comparing to owning, look at your cost of money with 100-percent equity tied up in the airplane versus only a share and what that would equate to per hour. Of course, you can only depreciate one- eighth of the cost, so the tax ramification can be complex. In our view, in the 50 to 200 hours a year range, you’ll come close to breakeven by owning a share of a new SR22 compared to splitting it with a partner or sole ownership. At least you’ll come close enough to rationalize the rest.

Airplanes for Everyone

OurPLANE takes a different tack in placing airplanes. Theyll go into any market where there’s interest, but commitment varies with the market. In areas where theyre looking to expand, OP requires that an airplane be 5/8 sold before theyll purchase it and put it on the airport. If its an area they didnt plan to expand into, the airplane must be fully sold.

OP also requires that the first airplane be sold before bringing in a second airplane. This has a greater potential for conflicts, but according to Graham Casson, President and CEO of OurPLANE, Five years of proof says there’s little problem with availability. Most OP locations have at least two airplanes at relatively nearby airports.

Our talks with OP owners yielded a mixed bag. The consensus was that OP did its best to keep customers satisfied. OP got high marks for responding to squawks and service issues and working to resolve scheduling conflicts, but sometimes only after repeated customer complaints.

Where there was only one airplane available, scheduling conflicts did occur-sometimes to the point where members have sold their shares. There have been some former OP owners and even a few employees who have been vocal critics of the operation as a whole, too. Its difficult to know exactly what happened here. The former OP owners claim OP over-promised and subsequently under-delivered or changed plans at the last minute. Some of these owners were actually fired by OP for violating OP safety and scheduling rules.Lessons learned have changed some OP policies with the intent of alleviating these problems, according to Casson.

OP share owners are not named on the aircraft title. This arguably provides better protection against liability if one of the other owners does something stupid with the airplane. In fact, ASE now offers this as an option for owners uncomfortable with being named on an aircraft title. On the other hand, it also means that your airplane is part of OPs equity. Thats fine as long as the company grows-as OP reports its doing-but if the company ever goes under, OP owners may be among many frustrated creditors. OP owners can place a lien on the airplane for the amount of their share, but its subordinate to any liens existing on unpurchased shares that OurPLANE has financed.

OP offers different levels of ownership, but each comes with different scheduling options. The exact details vary with location, but generically there are four levels of ownership: bronze, silver, gold and platinum. Each corresponds to a level of use. Silver is the 75 hours-per-year equivalent to ASEs 1/8 share. Gold users can fly up to 100 hours and platinum users have no limit on flight hours.

Weekday scheduling is the same for all users but platinum users can schedule up to three months in advance while bronze users can only schedule weekends two weeks out. This has caused issues where platinum users in some areas book popular summer weekends long before bronze users ever got a chance-only to cancel them later. OP has a new policy that you must fly at least 50 percent of the time you book or pay a per-hour fee.

Owners pay both a fixed and a per-hour rate. A 75-hour-per-year share in an SR22 in the New York area costs $799 a month with an hourly rate of $75. OP will sell additional hours as needed past that 75 hours at a reasonable $159 per hour. This provides an excellent buffer to fly a bit over your allotted time without upgrading your membership.

OP flies the SR22 G2 rather than the GTS. This means a lower acquisition cost with all the cool gadgets, but not the premium interior. This may provide a better resale value after five years. Getting out of the OP agreement is similar to ASE. The trial period is only by request and its 30 to 60 days.

Beyond that, you can sell your share for whatever you want during the five-year life of the contract. OP can help you sell it for a 5 percent fee. There was a policy of walking away for 80 percent the value of the share, but thats no longer an option on new contracts. At the end of five years, you get your share of the proceeds of the aircraft sale. OP requires that 75 percent of the selling owners roll their money into a new airplane before theyll commit to replacing the one being sold. Without that commitment, the airplane is still sold, but it isn’t replaced.

OP also has an executive program as we’ll as the FlySMART program, which would give you 25 hours in an SR22 over six months for $7399 without buying in. You can only buy the FlySMART card once though, to test the waters. After that, you have to buy a share. Of the seven people buying FlySMART cards to date, six have become OurPLANE owners, so the satisfaction level appears high.

Common Ground

The actual acts of scheduling and maintenance are virtually identical with ASE and OP. You can call or use online scheduling 24 hours a day. The same is true with a maintenance issue. You call a toll-free number, explain the problem and the main office handles the issue from there. If youre stuck out at Podunk Muni, both companies will do what they can to get you home or make you comfortable while you wait, but each case is handled individually.

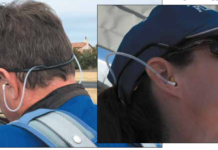

Both outfits let you schedule airplanes at other locations where they have airplanes based. ASE flies only the Cirrus SR20 and SR22 and all the airplanes have the same equipment installed regardless of location. OP has Cirrus SR20s and SR22s as we’ll as Cessna 182s with either steam gauges or the Garmin G1000. This makes using the OP network a bit more complicated. Of the ASE or OP owners we talked to, all loved the idea of using this network and spoke of how they planned to do it, but not one had actually done it. Some owners do use aircraft in two locations regularly, however.

Insurance is $1 million smooth through both companies. As part of a fractional, you’ll be paying your share of an average $17,000 per year premium for an SR22. This is thousands more than youd pay as a single owner, but comparable to what youd pay as a member of an eight-way partnership, if you could get $1 million smooth for an eight-way partnership.

Both ASE and OP contract with individual FBOs to provide service and storage of the airplanes. The quality of this relationship is a big part of your owner experience. OP has had some bad luck on the West coast that contributed to problems with dirty or unprepared airplanes. Theyre working toward a solution.

ASE has been doing its own training using staff instructors, but is looking at outsourcing this at some locations, as OP currently does. Youre always welcome to bring your own instructor, too.

Both companies include transition training time with your purchase and provide two hours annual recurrency time that doesnt count against your yearly hours. OP donates up to five hours per year to Angelflight missions you fly if youre a member of that organization. The New England office of ASE also sponsors seminars and talks for its owners.

Conclusion

Fractionals arent for everyone. But if you fly regularly, want a new airplane and are willing to pay extra to have someone else handle the headaches, then fractionals are a great, albeit expensive choice. Time has shown that the model works if managed correctly. Thats why were most impressed with Air Shares Elite. In our opinion, the focus on one airplane manufacturer, one market segment and a targeted segment of the pilot population makes sense. ASEs ownership structure is simple and protects your investment as much as possible. They seem to back it up with excellent customer service. In fact, the worst complaint we could coax out of any ASE owner was, We were getting frustrated and brought the problem to their attention and they fixed it.

OurPLANEs diverse vision cuts both ways. It may make their organization more complex, but it offers more options in more potential markets than ASE. Earlier problems seem to be generally resolved and owners report solid customer support, but in our opinion, scheduling and the safety of your equity stake are not as solid as with ASE.

Based on our discussions, your OP experience will largely depend on your regional office and how we’ll they referee the relationship with the contracted FBO and, to a lesser degree, OP headquarters. Get to know that person before you commit and make sure your level of ownership-and its privileges-meet your needs. Frankly, this is good advice if youre looking at any fractional operation, local or national.

Once you sign up, you may have the experience that many fractional owners seem to have: They fly more. As one owner put it with a smile, These guys are really dangerous. I used to fly 50 hours a year. Now I fly 100. If that isn’t a legitimate reason to own a piece of an airplane, at least its a juicy rationalization.

Also With This Article

“Ownership Costs: The Harsh Numbers”

“Fractional Extremes: VLJs and LSAs”

-Jeff Van West is editor of Aviation Consumers sister magazine, IFR.