It’s a sometimes painful truth of aviation: If you want something done right you need to go to an expert. That goes for finding the right technician for the type of airplane you own, getting flight instruction in backcountry flying or buying life insurance.

For pilots seeking life insurance the scenario is a familiar one—you finally realize that the odds are overwhelming that you’re mortal. After allowing that concept to sink in for a few days, you talk with the insurance agent who got you the package deal on your house and car and who tells you that getting life insurance will be no big deal. The agent also tells you that the annual premium for $1 million coverage will be, let’s say, $2,000.

HAZARDOUS ACTIVITIES

You fill out the application, putting a check in the box in the section asking if you engage in such things as scuba diving or flying general aviation airplanes. You take and pass the physical. Then your agent calls and says that everything is good, except the premium is going to be 40 percent higher than promised—$2,800—because you’re a pilot. In fact, even if you aren’t the pilot of the plane you’re in, you’ve got to pay the higher premium if you want coverage when you are in an aircraft that isn’t a scheduled airliner.

You quash the urge to loudly utter some choice Anglo-Saxon monosyllables into the phone and wonder why the heck you even started looking at life insurance—oh, yeah, because you take your responsibilities to your family seriously. Calming down, you explain to your agent that you’re a low-risk pilot—you have 500 hours of flying time, fly about 75 hours a year, take regular recurrent training, have had no accidents or incidents and have never had the FAA give you a second glance, much less consider a violation action against you.

It’s like talking to the hand—your agent doesn’t have a clue about anything you just said.

You ask whether there are any options. Your agent says that you can take the hit and pay the higher premium to ensure full coverage, or pay the original premium recognizing that the insurance will not cover you if you buy it in a general aviation aircraft. You consider and reject a third option—saying to heck with it and not buying life insurance. Even though you are a pilot and a tightwad, you did manage to grow up and become responsible.

TAKE THE FOURTH OPTION

There’s a fourth option available to you, one that we doubt would be suggested by your friendly insurance agent, but the one that we recommend: Take a little time to learn the basics about life insurance and then go to a broker who knows and understands aviation risks and specializes in providing life insurance to pilots.

INSURANCE 101

Insurance is a product that is purchased for the simple purpose of risk mitigation. By and large, if we have a risk of a financial loss that we cannot easily withstand, we insure the risk. Many pilots carry a multifunction tool—generically referred to as a Leatherman—because it comes in handy for things we need to do around airplanes as we’ll in our daily lives. A decent one can be had for $50. If we lose one, dropping $50 bucks stings, but it’s a risk we tolerate when we consider the overall cost versus the chance of the thing disappearing. We don’t buy insurance to protect against such a loss.

However, when it comes to the not-in-the-prime-of-life car we drive to the airport, the 20 grand it would take to replace it should we get sideways on an icy road and wrap it around a fire hydrant would do a lot more than sting when it comes to our budget. That car, maintenance hog that it may be, is an asset and we buy insurance to protect ourselves against the loss of assets we can’t easily afford to replace.

YOUR LIFE IS AN ASSET

It’s the same thing with life insurance. Our continued existence is an asset to our family, although our surly 15-year-old may currently hold a contrary opinion. We purchase life insurance to provide money to help our family carry on should the fire plug that destroys our car also extinguish us.

Basic “term” life insurance is just as it sounds—it is in effect for a given number of years, so long as the premiums are paid. It’s akin to insurance on your airplane, which usually has a term of one year, but usually for a longer term, 10 to 20 years.

There are other types of life insurance policies that include some degree of investment return or annuity in addition to the insurance portion—so some money is returned to an insured who survives the term of the policy. For this article, we’ll stick purely with the insurance portion of life insurance, not any add-ons.

Life insurance, as with any insurance, is priced by the employees at insurance companies known as underwriters. They are the math whizzes who assess risk of loss and rate of return on premiums—what you pay for insurance—to set the price of those premiums. Too low and the company goes under because it pays out more in claims than it took in; too high and the company can’t compete with companies that set premium prices more accurately.

In cold-blooded language, the underwriters calculate how many of their insureds are likely to die during the policy period so it can plan as to how much it will be paying out.

UH, WHAT’S A PILOT?

There’s one little problem—while underwriters know a lot about the law of very large numbers and how many people in a given statistical sample are likely to slip their mortal coil in a given time, few know squat about aviation and how to calculate risk for pilots. They tend to just stick pilots into a general pigeonhole of hazardous activity practitioners and bump up the price for their insurance—or refuse to cover them when engaging in the activity.

Naturally, going in as one of the great unwashed multitudes seeking to buy life insurance, you’re going to be rated as a higher risk individual and be charged more for insurance than might be realistic or simply denied coverage should you die in a bugsmasher.

SPECIALIST BROKER

Most life insurance is purchased by filling in a computer form that causes a software program to analyze the buyer and assign a risk and premium. That works for most life insurance applicants. However, pilots are not most insurance applicants—they make up only about a tenth of one percent of the U.S. population, so one-size-fits-all life insurance programs just shove them generally into a higher risk category.

Enter the insurance broker who specializes in placing life insurance for pilots. Specialized risk areas require specialized knowledge and a willingness to go to insurance companies to get pilots a premium price below the standard one-size-fits-all computer program, and the insurance company gets more customers—at a risk level that is realistic and profitable.

It takes a lot of time and effort, but a pilot life insurance specialist broker works individually with underwriters to come up with a more realistic risk assessment for pilots based on the ratings, experience and type of flying a pilot does—moving many pilots out of the high-risk classes.

So, let’s take a step back and look at how life insurance is priced, applicants classified and how a specialist broker can pay off for a pilot seeking life insurance.

RISK CLASSIFICATION

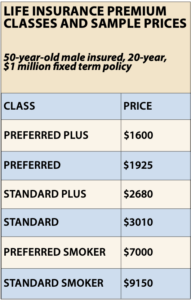

Underwriters have created seven risk classifications for life insurance applicants. They are, from least to most expensive: Preferred Plus/Best, Preferred, Standard Plus, Standard, Preferred Smoker, Standard Smoker and Uninsurable (the company will not write insurance for that person at any price). The smoker classification includes any type of tobacco use—yes, smokeless tobacco and vaping. A Preferred Smoker uses less than one pack a day.

As we did the research for this article we found that although health insurance rates for those not vaccinated for COVID-19 have already started to rise, it has not yet affected the life insurance market.

The chart at right shows the rates we found for the various classifications for a 50-year-old male buying a $1 million, 20-year term life insurance policy. (Rates for women are lower as they have a longer life expectancy and what data exists indicates that, as with automobiles, women pilots have a lower accident rate than men—we will not get into the testosterone-poisoning hypothesis regarding male pilot life expectancy.)

We then went onto the internet to get quotes for a 50-year-old in good health who is not a pilot. The average was $2700—apparently the internet sticks the “average” applicant into the Standard Plus classification. We note that the policies that would be generated from an internet application would have an aviation exclusion.

In a couple of internet insurance searches we did put in that the applicant was a pilot. That resulted in a nearly 25 percent rate hike if we didn’t want an aviation exclusion—to an average of $3350 for the annual premium.

We reached out to three life insurance brokers that advertise as specializing in pilot life insurance. Only one, Bill Fanning, proprietor of Pilot Insurance Center (www.piclife.com), responded. He advised that general aviation pilots are usually automatically excluded from Preferred Plus/Best and Preferred classes unless they go through a specialist broker. That matched with our experience on the internet—we were quoted rates above those of Preferred Plus/Best and Preferred even without disclosing that we were a pilot. The benefits of going through a broker are, in our opinion, obvious.

Fanning also told us that underwriters may apply one of 16 “table” ratings to a particular insured based on specific health issues faced by the individual. Each table bumps the premium charged. If the insured’s health cannot be accommodated by a table and associated premium bump, he or she is uninsurable.

There are also flat “extras” per thousand dollars of coverage based on an individual’s occupation/avocation. For example, Fanning told us that CFIs that give primary instruction are charged an “extra” above those who do not.

THE RESULTS

What has evolved from the efforts of Fanning and a few other specialists is that by providing objective data on risk levels for pilots to underwriters at life insurance companies, some would give at least a Preferred rating to pilots. He now has a group of life insurance companies—the identities are proprietary—that he can approach to get premium quotes that are significantly better than a nonspecialized broker can obtain.

We discussed with Fanning how various pilots are classified by underwriters. He told us that a pilot with a private certificate and at least 250 hours total time, who has been a pilot for at least five years, flies between 50 and 300 hours a year and has no DWIs, no caused aircraft accidents and no FAA violations, can usually get a Preferred classification.

By getting an instrument rating the pilot can get bumped into the Preferred Plus/Best classification. That’s a savings of $325 a year, which adds up over the years, and takes a little of the sting out of the price of the rating.

Are you a corporate pilot? Fanning told us that insurance companies he works with like them for their low risk. Night freight dog flying for a 135 operator? Not so much.

We note with concern for our homebuilding friends that Fanning told us that pilots who fly homebuilts are generally hard to place although he has obtained breaks for specific types of homebuilts such as the Van’s RV line.

OOH! COLD STETHOSCOPE!

Yes, you are going to have to take a physical to get the good prices. No, the physical is not as involved as an FAA medical. Fanning explained to us that the policies that don’t require physicals rely on healthy people to subsidize the less healthy ones—so the premiums are higher than policies that require a physical.

BUYING A POLICY

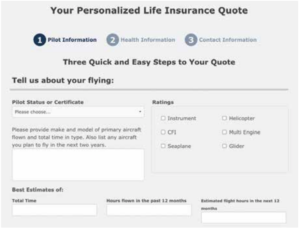

We like that Fanning’s company, PIC, has a specialized, tailored pilot life insurance policy application on its webpage. It takes less than five minutes to fill out and goes into some detail about you as a pilot—just what we would expect of a broker that is going to go into the insurance market to sell you as a good risk to an insurance company.

Fanning told us that after filling in the application you’ll be contacted for a copy of your medical records and to schedule your physical. In three to six weeks you’ll have your policy. Once you’ve paid the first premium you’ll be covered.

CONCLUSION

Our bottom line is that if you’re a pilot and want life insurance, it’s a no-brainer to buy it through a specialized broker. In fact, based on our foray into the world of buying life insurance on the internet, even if you’re not a pilot it looks to us as if a pilot insurance broker can probably get you a better deal.