If airplanes have personalities, so do the engines that power them and, by extension, the companies that make those engines. Traditionally, Teledyne Continental has been known as an innovator, testing the market with cutting-edge products such as the water-cooled Voyager engine and, more recently, the PowerLink FADEC system.

In contrast, Lycoming has been more of a staid presence, with a reputation for delivering reliable engines and uniform parts and supplies for the aftermarket, but with a conservative reticence toward radically new products.That settled notion was set on its ear in early 2002 when Lycoming announced that it was recalling some 400 crankshafts for high-horsepower six-cylinder engines. The recall eventually blossomed to 950 crankshafts, grounding many owners for months and forcing Lycoming to engage its competitors-field overhaul shops-to meet the intense demand of overhauling so many engines at once. A second recall in 2005 involved 1100 more shafts.

To its credit, Lycoming accomplished the task in record time and generously supported grounded owners with funds to cover replacement rentals, interest payments and hangar fees. But troubles were still ahead for Lycoming. In the inevitable legal wrangling that followed the recall, Lycomings crankshaft supplier, Interstate Southwest Ltd., won a $96.1 million suit against the engine maker after a Texas jury found in February 2005 that structural deficiencies caused the failures, not overheating of the billets by Interstate, as Lycoming had claimed. Lycoming is vigorously challenging the suits technical findings and says its confident the verdict will be overturned on appeal.

In the meantime, Lycoming is busily re-inventing itself to operate in an industrial world increasingly defined by lean manufacturing methods and sophisticated quality control systems of the sort designed to prevent defective crankshafts from reaching customers.

In September 2004, Textron brought in a new executive to run Lycoming: Ian Walsh. Before taking the helm at Williamsport, Walsh was in marketing and sales at Textrons Bell Helicopter unit where he was responsible for developing value-based pricing strategies for all of Textrons divisions.

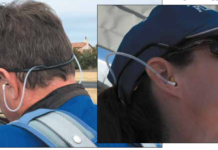

As a certified Six Sigma Top Gun and Black Belt, hes we’ll steeped in the details of statistically based quality control. In addition to being a U.S. Marine Cobra helo pilot, he also flies a Lycoming-powered RV-8 Experimental.In October, we visited Lycomings Williamsport plant where we toured the factory floor and interviewed Walsh. Heres our report.

———-

First, whats the status of the Interstate appeal?

The appeal is an ongoing, long process. We completely disagree with that verdict and there are a lot of reasons why. Quite frankly, thats all I can say at this point. Im excited to get through that appeal process because I think we have a very strong position.

Can you characterize the major technical points of the appeal?

I cant. Im not specifically involved in it yet.

From a customer perception perspective, how much damage did the recall and the lawsuit do to Lycomings reputation and how are you addressing that?

I would say that the consensus is that customer perception is changing and its changing in the right direction. Thats what I hear all the time. I think there was clearly a perception that Lycoming suffered on the crankshaft recalls. The response from Textron was the right response. And now there’s a perception that weve started to move the needle.

I think people understand now that there is a new leadership team in place. We have a supportive corporation and they have, frankly, fixed a lot of the past problems with the receiving inspections and the supply base. Is all said and done? No, there’s still a long journey ahead to the next level of performance.

Do you believe Lycoming has a good understanding of all of its internal shortcomings and, bluntly, can fix what needs fixing?

In certain dimensions yes, on others we still don’t. We havent collected enough information to know. Certainly, we had a mistake or a flaw in the manufacturing process. That was reconciled and now were monitoring that with data on a day-to-day basis.

Weve spent a lot of time on the technology side and now were moving into the service and support arena. What I want people to understand about Lycoming is that we are focused, first, pure and simple, on safety. From there, we want to really improve our processes so we statistically know the performance, so internally, having that data is whats so critical. Because if you don’t, you truly are making a best guess.

Speaking of the support side, one complaint weve heard is that Lycoming is slow to return calls and e-mails. Are there more people on the phones now?

Yes, no doubt about it. We have reorganized and set a different level of expectations in those service and support roles. We are working on process improvement and working other channels to the market. For the service bulletins, yes, we actually brought people in.

On a day-to-day to basis, weve made some changes to refocus and retrain customer service people on what their priorities are. Weve streamlined the incoming information so we are more responsive.

We are trying to get responses so that the customer is directed to the right person. When Im on the factory floor here and someone says, You know I have a problem, my world stops and I focus on that person. Thats not what was happening in the past.

What about direct dealings with customers? How has that changed?

People-wise, weve put our best on our biggest accounts. Weve removed some folks and rewarded our best people with t op accounts. Second, were looking at how we manage our discrete customer base.

One thing that wasnt understood in the past is that you cant apply a unilateral approach. OEM customers are different than aftermarket customers.For example, the aftermarket customer is chiefly interested in price and responsiveness, an OEM is chiefly about cost and quality.

During our tour, you explained some of the Six Sigma and kaizen efforts being put into place. Isnt this coming a little late to Lycoming? These methods have been used in the auto industry for years.

Six Sigma is constantly being refined. So our deployment of Six Sigma is much more inclusive. Its best-practice oriented. When Textron stepped up, they said were going to translate this into the best solution that works for us and thats what theyve done. Quite honestly, its been deployed extremely fast. Its one of the fastest deployments Ive ever seen.

But why did it take so long for Lycoming to get to this?

Lets be careful in how we describe this. Weve always had quantified approaches to quality. Now, we are just taking it to a higher level. I think Textron has realized there’s an opportunity to get more of a standardized understanding of how were approaching the business day to day, versus the older model, which was more subjectivity and more variance.

Earlier, we watched you close out a kaizen event. How does this fit into the overall quality-control scheme?

We talk about what were doing under the umbrella of Six Sigma. Six Sigma involves lean, it involves design for Six Sigma. Its not just one or the other, its all inclusive. So when we talk about kaizen events, its not just kaizen, its part of the entire process. Weve kaizend the test cells, weve done the crankshaft department, were doing the trim line right now. Then were going to do the advanced technology center.The primary focus has been on the assembly, then it expands from there. Thats why the test cells have been part of the process. By the end of the year, we’ll probably have 90 percent of the employees at a basic understanding of what Six Sigma and lean is.

If Im a United Autoworkers machinist down on the line, how does all this new age stuff affect me?

I wish you could hear the reports from employees that we hear. Youll hear comments like this: This is the first time in 20 years that Ive been given the chance to physically and mentally improve my process or my area. Its the first time weve seen a more collective approach to problem solving. The time and attention to training thats going on now is something we havent had in many, many years.

When I came here, there were systemic problems. Not having a union contract was a problem that affected everything. The people who do these jobs know them inside out and thats great. But guess what? We have now set up a system where there’s no variation and where there is no subjectivity in parts manufacturing.

Given the enormous cost of the crank recall, does Lycoming have the financial resources to both re-invent itself and pursue new technological initiatives?

The answer is yes, but its a challenge. You have to pick your targets carefully. The cost of any type of new engine development is large. And Lycoming is part of a large organization. Were competing with resources and capital, so we have to justify those business cases. Whats exciting is that much more than in the past, we have more expertise to go to market with some of those key programs.

Whats in the pipeline for new products? Electronic controls?

We are absolutely working on electronic controls. We are working on diesel technology. We are working on new cylinder designs. We are looking at pulling weight out of our engines. We are looking at the light sport aircraft market.

How about a clean-sheet engine from Lycoming? Will that happen?

Thats a multi-pronged challenge. What will it be? Is it a heavy-fuel engine? Is it avgas? What horsepower? It could be anything from full FADEC to engine diagnostics and pre-flight sensing.

Whats the FADEC time frame?

Its realistic to say … certified and producing in the market … three to five years.

What about diesels? Continental went there and has placed the project on low boil. Thielert has obviously made market inroads.

You hear a lot about diesels and its all real. I think its going to happen. I see it as a little bit of a medium term. Were going to go after that, but the market acceptance is five years out and avgas is always a moving target. If you look at whats going on in Europe and in the Pac rim, avgas is just not available.

One of the other things were focusing on is the DOD component. There’s a UAV demand for heavy-fuel engines and piston engines. Were trying to get a sense of what those target areas are going to be for us. Were getting a lot inquiries.

Will we see new avgas engines?

Yes, probably. I think thats going to be higher horsepower, Im talking 350 horsepower and north. I think its for an airplane for six people, cruising 10,000 feet to 20,000 feet, that can compete with the mini-turbines and the small jets.

In the short term, its going to look similar to what were accustomed to. But in the longer term, maybe 10 years out, youre absolutely going to see holy smokes, whats that? Youve got to remember that its a slow change. Its hard to predict whats going to happen in the market.

How about a small turbine engine in the near future?

No, thats not our focus right now.

With avgas topping $5, will fuel specifics somewhere in the sub .40 BSFC range be a consideration?

Economy will be a consideration. We just don’t know the details yet. At this point, we don’t even know what we don’t know. Right now, we are thinking about trying to generate the kind of power and performance capabilities the market wants. Weve very carefully worked on the wording of our mission statement. We want to be the premier engine company-it doesnt say piston-engine company. It says wed like to be the premier engine company.

Thats the challenge for a company with our history. To change that mindset. But we will.

Also With This Article

“The Zen of Six Sigma and Kaizen”