In 2014-five years ago almost to the day-Airbus announced that it was bullish on the electric airplane idea and would certify the hybrid four-seater E-fan 4.0 for the U.S. market by 2020. In the meantime, it made a PR splash by flying what would be a two-seat trainer-the E-fan 2.0-across the English Channel.

Two years later, Airbus said, never mind. Not that it’s no longer bullish on electric aircraft, but it has moved on to an even more ambitious project in the form of an electric hybrid single-aisle airliner in partnership with Rolls-Royce and Siemens, the dominant force in brushless DC motors used for aircraft.

If anyone in the nascent e-flight business was surprised by this development, they were polite enough not to say so. The real electric airplane market remains a village cottage industry and I learned at Aero in April that the village is very busy indeed. The overarching picture is this: The certification rules are in place, or soon will be, to certify electric aircraft, battery capacity is improving glacially and two companies-Bye Aerospace and Slovenia-based Pipistrel-are set to deliver airplanes in commercial volume. Actually, Pipistrel already has, with about 60 Alpha Electro trainers in the field around the world. But lacking regulatory imprimatur, these have been more technology demonstrators than practical, useful airplanes.

Regs Catch Up

One effect of having major players like Boeing, Airbus, Siemens and Rolls get into the e-aircraft game is that regulators got busy catching up, at least for light aircraft certification.

“One of the things people have talked about is light sport and in light sport, electric airplanes currently don’t fit,” says Greg Bowles, who oversees certification issues for the General Aviation Manufacturers Association.

“One of the things we’ve been doing over the past 10 years is to change Part 23 to performance-based standards that are very prescriptive and detailed. As a result, Part 23 doesn’t talk about liquid fuel or electric. The rule is high level and it’s very broad. That was the intent,” he adds.

Under the Part 23 revision, known as CS23 on the global stage, the regulatory language is broader, with the details filled in by consensus standards developed by ASTM. This follows the method used for the light sport aircraft rule developed by the F37 ATSM committee. The electric standards are coming out of the F44 working group. An early draft of ASTM electric airplane standards has already been approved by the FAA.

“It doesn’t encompass everything everyone is going to want to do in electric. Some people want cooling systems, some people want hybrid systems. We’re working on those revisions at the moment,” Bowles says.

For example, it’s likely that early electric cert projects like Bye Aerospace’s eFlyer will raise specific issues not addressed thus far. “But what’s happened is that the FAA has been heavily engaged in this, so if someone says, ‘hey, I want to do that early,’ the FAA has been willing to accept that,” Bowles said. He views the consensus standard as a living document that’s revised on the fly as needed on about a six-month cycle.

Bowles describes this as more fluid and flexible than past certification oversight and although others I’ve spoken to in the industry think the consensus standards are pointed in the right direction, there’s also a wait-and-see attitude on both the timing and the economics.

Bye Aerospace

Not in evidence with a display at Aero, but with an evidently open order book, was Bye Aerospace. The company bagged 60 orders for its under-development eFlyer pure electric trainer. A Norwegian flight academy placed the order, according to George Bye.

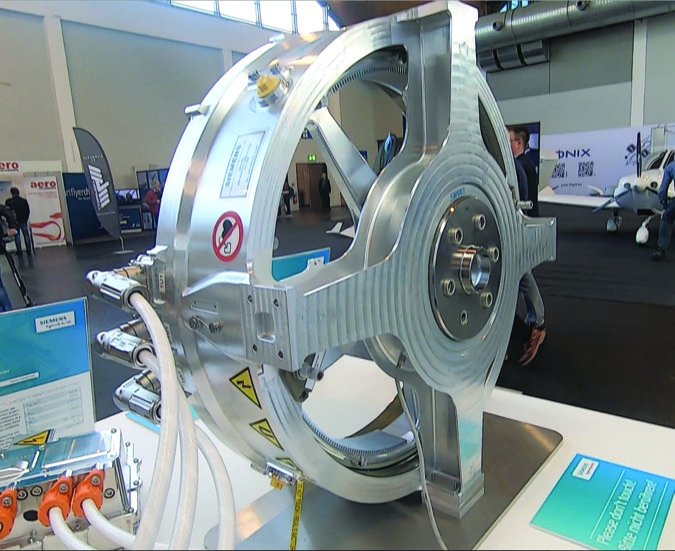

Prior to Aero, I visited Bye’s Denver headquarters for a look at what will be the eFlyer, the follow-on product to the Sun Flyer airplane the company showed at the major shows for the past couple of years. The eFlyer is a two-place side-by-side combined carbon fiber and fiberglass design powered by a Siemens 90-kw (115-HP) motor with a claimed maximum flight time of three hours.

“For a 2000-pound trainer, it’s just the right balance of power, thrust and weight,” Bye told me. The eFlyer uses LG Chem lithium batteries with a claimed energy density of 260 Wh/kg, the highest of any of the manufacturers we spoke to. The airplane will have a three-blade composite prop and a Garmin G3X Touch system adapted for electric aircraft use.

When I visited the company, the proof-of-concept airframe had been flown a couple of times. Following the consensus standards GAMA’s Bowles described, Bye is aiming for certification and market entry in about two years’ time-sometime in 2021.

In the trainer configuration, the eFlyer will have 450 pounds of payload and a speed envelope between 60 and 90 knots, with a dash speed of 135 knots.

“We’ve got more than enough energy for typical flight training sorties-one hour to 1.3 hours. A quick charge and we’re ready to go right into the second sortie,” Bye said.

Bye predicts 15 to 20 minutes of charge time and a battery life of 1500 cycles or about 1500 hours, after which the entire pack would be replaced with new cells.

“What’s really cool about that is that the batteries are getting better. So the three-hour eFlyer now becomes a four- or five-hour eFlyer,” Bye said. But those batteries aren’t cheap and neither will the eFlyer be. Projected sticker price is $349,000 equipped as a trainer, but more for private owners who might add options.

The payback is in projected operating costs. The company says the eFlyer will cost $20 an hour in direct operating costs, with most of that-about $8-allocated for battery replacement and the rest for general maintenance and possible upgrades. “Some might call that too conservative. But we want to make sure we have allowances for the unknown,” Bye said.

Pipistrel Electro

Electric airplane ideas come and go at Aero and some are either artist renditions or lab projects one step beyond. One that’s neither is Pipistrel’s Alpha Electro, the first commercially saleable electric airplane, albeit one that’s not certified. Yet. A visit to Pipistrel’s booth reminded me of a Tesla dealer.

Pipistrel’s Electro is an adaptation of its Rotax-powered Alpha trainer. It uses a homegrown 50-kw-plus (67-HP) motor and a battery array of Pipistrel’s own design. The 60 or so Electros in operation around the world face a patchwork of regulation that has made it difficult for the airplane to gain a foothold in the training market.

To address that, Pipistrel’s second-generation Electro will be a certified aircraft using similar consensus standards George Bye’s eFlyer is following. Some countries already allow electric flight under

ultralight rules and some are evolving in that direction. Some, says Pipistrel CEO Ivo Boscarol, just close one eye.

“It’s nice to be a pioneer, but it’s hard to live like this in aviation,” he says. The Electro is reliably a one-hour electric airplane, plus reserve. That makes it suitable for pattern training or short forays to the practice area, but not cross-country flying. For interested schools, Pipistrel recommends buying three Electros and one gasoline Alpha for cross-country and other training where the electric airplane lacks endurance.

“The batteries are still the issue. They are not designed for aviation. The cycles are not as we wish because of the very high C Rating we must use,” Boscarol adds. (C Rating refers to how fast a battery can discharge for a short, burst time.)

“But if I’m honest, we have sold more aircraft than I expected and now we are receiving four to five orders per month,” Boscarol told me.

Because of high battery costs, electrics cost more than gasoline-powered aircraft. The Electro sells for €125,000, plus another €13,000 for the charging system. (That’s $139,720 and $14,530 respectively.) The gasoline-powered Alpha sells for €83,100 or $92,869.

As battery capacity remains an issue, so does battery cycle life. As a battery replacement rule of thumb, Boscarol says the cost will be about the same or a little less than overhauling a Rotax engine. So the operational cost delta for the electric is essentially the cost of gasoline and maintenance for the engine. That’s not trivial, but with a $61,000 higher price and given the electric’s endurance limitations, it’s hardly a slam dunk.

Recharge times are between 40 minutes and three hours, depending on the charger system. For its next generation airplane, Pipistrel is considering faster-charging water-cooled batteries. When the Electro was in development, quick-change batteries were considered, but that idea has been shelved.

Hybrids

With sales of hybrid electric cars on the rise worldwide-but down in the U.S.-the idea has been migrating to aviation in the form of numerous projects we saw at Aero, some of them aimed at small aircraft, some of them ambitious commercial products that are years away.

By far the most lavishly funded is one called MAHEPA, one of those classic EU acronyms for Modular Approach to Hybrid Electric Propulsion Architecture. Pipistrel’s Igor Perkon explained that the idea is to develop common building block solutions for hybrid electric drives and prove the hardware in a way that can be scaled up.

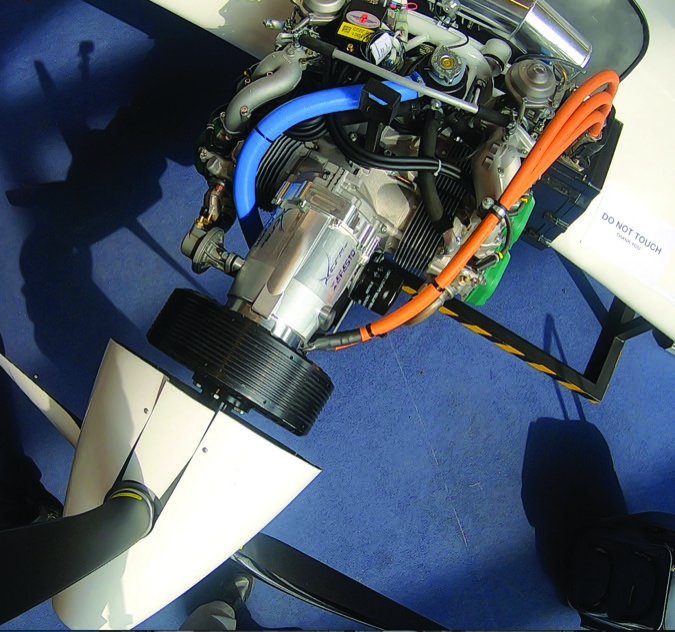

The advent of light, powerful brushless motors has led designers to salivate at the potential of distributed power-placing thrust anywhere on the airframe rather than just as a tractor or pusher. But battery limitations force the reality that realistic continuous power will have to come from hybrid drives of some kind. MAHEPA follows another project called HYPSTAIR, a hybrid drive system that used a Rotax engine and generator in conjunction with a battery array. Pipistrel led the development on that and although it wasn’t intended to fly, it did prove the concept with ground runs.

“We are strong believers in this solution because it scales up easily to higher powers and thus higher takeoff weights using a distributed propulsion approach,” Perkon told me. “With the range-extending technology of a generator, plus internal combustion engine or fuel cells … serial hybrid aircraft carry lighter powertrains and most important can perform all-electric taxiing, takeoff and climb, which we see as the typical mission scenario,” he adds.

Three other hybrids were shown at Aero, including a parallel drive from an Italian company called Alpi Aviation that places a 70-HP motor in parallel with Rotax engines in a twin through clutch mechanisms, providing for electric taxiing and boosted takeoffs.

Another parallel hybrid is called H3PS and is a joint venture of Tecnam, Siemens and Rotax. The goal is similar to MAHEPA, to produce a flyable, scalable proof of concept. The test article is a P2010 with the 180-HP Lycoming removed and replaced with a Rotax 915 iS. An electric motor in parallel replaces the horsepower shortfall.

Last, a German company called Comco Ikarus was showing a serial hybrid powered by a small two-cylinder engine in the back of the airplane driving an electric motor through a battery array. The company says it’s a proof of concept rather than an aspirational product.

What It All Means

There’s a danger here of getting the cart before the horse and when I asked Nicolas Chabbert of Daher about electrics, he said that’s exactly what happened with Airbus. Daher was brought on by Airbus as a developmental partner in 2014 to help with the certification path. “There was a mismatch between what was communicated and the reality of the projects,” Chabbert says. “It was way too premature. There was no product there,” he adds.

And while he thinks Bye Aerospace is on the right track with its eFlyer, none of the projects in view now are disruptive enough to reshape the market, in Chabbert’s view. With almost two decades of electric experimentation, Pipistrel’s Ivo Boscarol is similarly cautious.

Yes, the regulations are coming together and yes, batteries are getting better, but the economics of the light trainer market remain an uphill struggle for electric airplanes. Short endurance and charge-time waits are a nuisance, not a feature.

Pipistrel sales exec Michael Coates told me there’s a certain novelty factor in buying an electric airplane or putting one on the flight line for training. But that’s neither enough to drive a sales boom nor attract-at least thus far-people wishing to learn to fly who might resonate with the green idea of an electric airplane.

Yet Pipistrel has found buyers who might be called the hardcore early adopters. Some are flight schools, some are private owners. “They’re usually driving a Tesla or a Prius. They buy the airplane because they feel guilty about damaging the planet and they’re willing to put up with the limitations,” Coates adds.

He believes the electric market will reach a turning point when endurance is routinely at three hours. That’s what George Bye predicts for the eFlyer, but I’d like to see it demonstrated before saying the corner has been turned.

Battery cycle life still remains an unknown. Pipistrel’s Ivo Boscarol says the company believes the Electro will need two battery sets or perhaps a little less in the same 2000-hour TBO run for a Rotax gasoline engine. Again, the technology has too little recent history to prove if this is deliverable or if it can be improved. Without that history, Bye Aerospace claims to be there. But it will be another three to five years before we know if that claim is credible.

One Year: Four Electros

Finding an electric airplane to fly in the U.S. is all but impossible because the only choice-Pipistrel’s Alpha Electro-isn’t certified and isn’t recognized under the light sport rule.

A California group called the Sustainable Aviation Project got around this by flying the Electros under an experimental arrangement. They bought four Electros with a local grant from Fresno County, California, as an advanced transportation demonstration project.

SAP’s Joseph Oldham says the four aircraft have been flying for a year and have accumulated some 170 hours in what’s largely a demonstration role. Oldham says the group has spent the time testing, validating performance and learning the limitations of electric flight.

The verdict? “The aircraft have quite a lot of capability. Pipistrel designed it as a pattern trainer, but it can actually do more than that if you have the infrastructure set up so that airports are relatively close to each other,” Oldham says. That means installing charging stations at more than one site.

The Electro POH recommends that the airplane be flown so as to land with a battery charge of no less than 20 percent. Oldham says that gives the airplane about a 50-mile range. “I now fly them about an hour and still have a good reserve. In the pattern, they’re easily an hour or a little more, because you regen on every descent, ” Oldham says, referring to Pipistrel’s unique propeller that drives the motor and returns power to the batteries.

Oldham says touch and goes aren’t recommended because the batteries do better at absorbing the regeneration charge if they aren’t immediately asked to deliver takeoff power. The group bought 15-kw chargers for the airplanes, one stationed at each of three airports. Typical charge times from 20 percent are between 90 and 100 minutes, Oldham reports. “You don’t have to take them back up to 100 percent, if you just want to do a couple of laps around the pattern,” Oldham adds. When we asked Pipistrel’s Ivo Boscarol what maintenance the airplane requires, he said none. Has this turned out to be true for the SAP fleet? “They’re super reliable. There’s just one moving part. There’s really nothing to do with the battery packs. You just monitor the system,” Oldham told us. He said one motor developed a rough bearing and Pipistrel sent a replacement. “There’s no runup, there’s no warm up. You just taxi out and take off. It’s simple operation. As a trainer, I think it’s awesome,” Oldham says.