As this is being written the stock market is in record territory, aircraft insurance rates are at record lows, the Fed has just started to raise interest rates out of the basement, the economy is at full employment and the incoming administration is promising to cut taxes while spending massive amounts on economic stimulus. Is this a great time to finance an airplane or what?

Our crystal ball is foggy; we don’t know if promised financial deregulation will spur the economy or blow it up via the savings and loan debacle or Wall Street monetizing mortgages. What we do know is that aircraft loan rates are still at historic lows, aircraft prices have been stable and banks that make aircraft loans are competing for your business.

Our survey of the aircraft finance market turned up lots of optimism. Bob Howe, president of Dorr Aviation Credit Corporation (www.dorraviation.com) said that since the election their phones have been ringing constantly. Dan Garzelloni, principal of Mile High Financial Corporation (www.milehighmoney.com) told us that even though he’s seeing a slow increase in interest rates, they will have to increase substantially before they adversely affect aircraft sales.

The bottom line is that right now a person interested in buying a piston single or twin should be able to get a 20-year fixed rate loan with an interest rate of under 5.5 percent with a 15 percent down payment. Rates for turbine equipment are in the 4 to 5 percent range, with 15 to 20 percent down.

First Steps to Buying an Aircraft

You just had another lousy experience with a rental airplane and decided it’s time to quit renting. You’re ready to buy. You’re going to need to finance the purchase, but the bank where you got your mortgage and car loans doesn’t know a Piper from a Pilatus and won’t touch aircraft loans. Where do you go to get a loan at the best interest rate?

We do not recommend that you simply start contacting banks that advertise aircraft loans. In order to find out what rate you’ll get from a particular bank, you’ll probably have to go through the application process. That means the bank will “pull” your credit—do its due diligence and get your credit report. Every time your credit is “pulled,” your credit rating takes a small hit—it may be as much as five points. If you apply to four banks, the jolt to your credit rating can be noticeable.

We recommend that rather than shopping for the right bank that you shop for the right aircraft finance broker. An aircraft finance broker is a financial professional who knows the aircraft world (and is almost always a pilot). His or her company works with a number of banks—usually between three and six—that specialize in aircraft loans. The broker will learn about you (and you about the broker) and will be able to tell you pretty accurately what kind of deal you can make before you apply. We also recommend that you tell a broker that you are also speaking with other brokers—you want them competing for your business.

Once you decide on a broker, he or she pulls your credit just once even though the broker may be talking to several banks to get you the best deal—so your credit rating only gets one nudge.

There is a broker’s fee; however, it’s paid by the lender, not you.

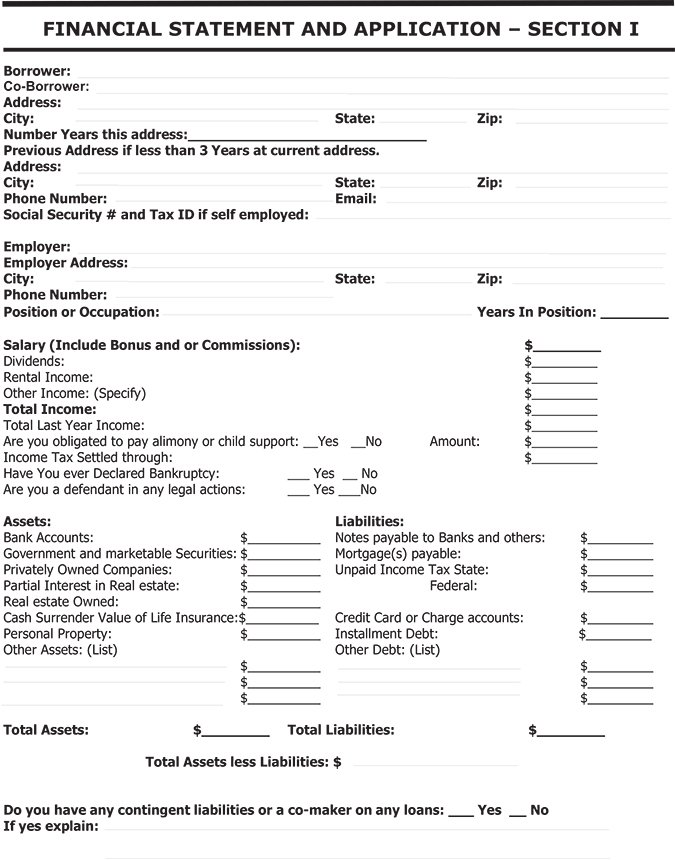

The application process is more involved than buying a car, but less than a house. From what we’ve seen, the application form is standardized. You’ll be required to disclose assets and liabilities in full. Plan on providing your income/earnings information (all sources of income), several months of bank statements and at least two years of tax returns.

Give everything to the broker in one package—one of the best ways to mess up an aircraft loan application is to provide information piecemeal.

Steve Smestad, owner of Airfleet Capital Inc. (www.airfleetcapital.com) said applicants should “fully disclose” on the application. He said that from time to time he’ll have an applicant “pencil whip” the application and not disclose all assets. When the bank does its due diligence it often finds those assets and may get suspicious as to what else the applicant has hidden, especially if it’s any liabilities—and it can result in denial of the application. Post-2008, there has been a lot more pressure on lenders to know their customers and actually perform their due diligence before approving a loan.

Aircraft Financing Advice

One of the positive side effects, in our opinion, of working with an aircraft finance broker is that he or she usually knows the market we’ll and can advise you on everything from how to effectively present yourself on the loan application to what kind of airplanes banks like to make loans on. For example, Bob Howe said that it’s extremely difficult to get a loan on an airplane that is an orphan—where there is no factory support—such as a Bellanca Viking or the Aero Commander 112 and 114 series.

On the other hand, Howe told us that the bread and butter airplanes for the banks—the ones they prefer—are high-performance piston singles such as Cessna 210s and 400s, Piper Saratogas and Malibus, Cirrus SR22s and the Beech Bonanza line as we’ll as all piston twins.

Brokers also told us that one of the best things a prospective owner can do is to get financing approved before picking out an airplane. That way the buyer knows the precise limits of his or her budget and can negotiate accordingly as we’ll as move fast once finding the right airplane—assuming it passes a rigorous pre-purchase examination.

Steve Smestad also told us that the type of flying the owner plans to do will affect the interest rate and term of an aircraft loan. If you are buying an airplane you’re going to fly 150 hours a year, you’ll be looking at the low end of the interest rates, a 15 percent down payment and a full 20-year amortization. If you’re going to lease the airplane back to a flight school where it will fly 100 hours a month, you’ll be probably pay near the high end of the interest spectrum, probably have to put 20 percent down and will have a less than 20-year amortization period.

Plan on being able to finance no more than 85 percent of the Vref/Blue Book value or the agreed purchase price, whichever is lower. We note that some lenders will make an exception for recently refurbished airplanes. Knowing that you won’t be able to finance more than 85 percent of book value gives you leverage in negotiating with a seller who argues that “book values are too low.”

Conclusion

We think that even though interest rates are slowly creeping up that it’s a good time to buy. We recommend arranging your financing through an aircraft finance broker and getting your financing approved before you make a decision as to which airplane to buy.