The market for aviation insurance continues to be soft—perhaps very soft. There are simply too many aviation insurance companies offering to sell policies, relative to the number of aircraft owners looking to buy them. And each of these too-many companies is trying to keep the customers it has, and to grow by taking customers away from one of the other companies.

This is good for you, of course, because it means you could score rates cheaper than we’ve seen in years, plus have a better chance of getting covered to fly a complex machine. But it isn’t exactly a free-for-all. There are still some gotchas in the aircraft insurance world you need to know about. In this article we’ll cover them and take a fresh look at the market and what it might cost for a policy.

Well-Qualified Winners

The problem with today’s market, as insurance people say, is capacity. In today’s domestic general aviation insurance marketplace, there is an overabundance of capacity, or money. In order to insure things, insurers need money, which is set aside as reserves. When there is more capacity than is needed, we have a soft insurance market.

Most industry people will tell you that the current soft market started around 2006, making this cycle the longest that anyone has seen. And it shows no signs of letting up. Depending upon how you count, there are about 40 percent more companies selling aviation-related insurance than there were 10 years ago. The number of insurable airplanes is remaining relatively flat, and so, fortunately, is the number of accidents. But the cost of repairing airplanes and defending lawsuits is going nowhere but up, so insurers have their work cut out for them.

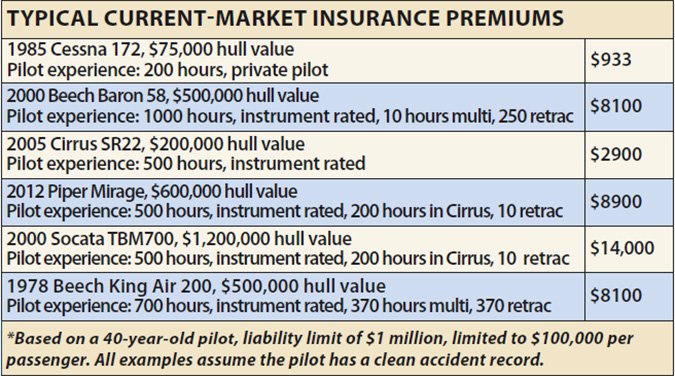

The largest and most obvious effect of this embarrassment of riches is reduced rates for aircraft insurance. The main beneficiaries are corporate operators, many of whom are paying 30 percent of what they paid for insurance 10 years ago. The breaks that light airplane owners are getting are less dramatic, but still quite tangible. Most light aircraft underwriters who we spoke to felt that their pricing was off between 20 to 40 percent during that same time.

In general, the people who are benefitting the most from the price breaks are those who are the most attractive to insurers. Light singles have fared well. Piston twins—especially cabin-class models—have seen some breaks, but less than some of the other classes. Turbine airplanes flown by trained and well-qualified owners have seen substantial reductions.

Most underwriters said that their experience with light sport aircraft (LSA) was mixed. Because these airplanes only have two seats, the liability exposure was somewhat less. None offered hard numbers, but most insurance company people that we talked to felt that light sport airplanes often failed to have the robustness built into some legacy trainers, and that light stick forces in some led to landing accidents.

The overall picture for all types is a little muddied by the steady erosion in the value of most light aircraft. But even allowing for this, insurance rates have come down substantially for almost everybody.

More Coverage for Less

Another effect of the continued competitive market is a gradual increase in the coverage provided to aircraft owners. This has taken on two forms. Insurers are being pushed to offer higher limits of liability coverage by other insurers who are willing to provide them. Higher limits are being demanded by brokers who want to provide better protection for their clients, and who are trying to replace some of the losses to their percentage-based commission incomes.

In addition to higher liability limits, insurers are broadening the coverage provided in their standard policies to make their products more appealing to consumers. Most light aircraft policies now contain expansion endorsements that contain various ancillary coverages, mostly at no or very low cost. These range from providing coverage for rental of the insured airplane to listed pilots, to expanding the geographical territory where the airplane can be flown, to including coverage for the extra expense of renting an airplane to fill in for the damaged insured airplane while it is being repaired. Not every policy comes with these extras, but far more do than was the case 10 years ago.

The final frontier in this ongoing competitive market is underwriting guidelines. We have watched prices drop, coverage broaden and rise and now we are beginning to see sporadic slackening of underwriting guidelines. For instance, companies that had strict policies about limits provided to older pilots are rethinking their positions in order to hang on to some of their customers. It’s easier in the advanced aircraft world, too.

Companies that required annual training for pilots of pressurized airplanes are now looking at training every other year. Companies that required annual simulator training for owners flying jets will sometimes relent and allow in-airplane training. Insurers who insisted that a new jet owner be accompanied by an instructor pilot for 50 hours after completion of school now may only require 25 hours, or simply that the owner graduate from the initial training and receive the type rating.

This is still more the exception than the rule, but an insurer that rigidly sticks to its guidelines is now in danger of losing business to a rival that, depending upon your point of view, is either more competitive or less disciplined. The companies are not throwing out their underwriting guidelines wholesale, but rather some of the companies are doing so selectively. They are more likely to make exceptions if they feel the pilot is a good fit for the airplane.

Consider that if you are an underwriter and one of your customers receives a competitive quote from an insurer willing to take on the same risk for less money, or the same risk with less training or to offer more liability protection for the same premium, then you have a tough decision to make.

Hangover

None of this is particularly new. Aviation insurance has always been a cyclical business, with fairly strong ups and downs. Most cycles, either hard market or soft market, last three to five years. What is different is the duration of this soft market cycle. Nobody has seen a cycle that has lasted for 10 years, with no obvious end in sight.

General aviation insurance is a very small piece of the worldwide insurance industry. While GA insurance rates are affected by GA accident rates, they are more driven by external forces, such as catastrophic events like windstorms, or economic developments. In part, this current soft market is a hangover effect from the financial crisis.

The cost of money is still historically low, and this more than anything else is what drives the cost of most types of insurance, including aircraft insurance. But compared to many other investment opportunities, general aviation insurance still looks fairly attractive, or it did five years ago. Hence the parade of new companies and the flood of capacity.

For consumers, a soft market is about 90 percent good news—maybe 95 percent. In fact, the only bad thing about it for consumers is that it will not last forever. At some point, the cost of money will increase, or a cataclysmic event will take place, and suddenly there will not be enough capacity. The soft market could come to a sudden, screeching halt, or it could end with a whimper.

But sure as gravity, at some point insurance for your airplane or helicopter will become more expensive, more restrictive and possibly less available. We are already seeing individual companies that are no longer offering larger limits of liability as they did two or three years ago.

Tips for Buyers

We spoke to underwriters and to a number of insurance brokers about tips for prospering in a buyer’s market. The advice they gave us was suspiciously similar to what we were told during the last hard market. Underwriters particularly stressed the importance of long-term relationships between the aircraft owner and the underwriter, and most brokers agreed.

Having a long-term relationship with a company will often lead to a better solution in a claim situation. In the event of a gray area, the insurer is more likely to bend a little in favor of a long-term customer.

Another reason to stay with an insurance company over the long haul is that the company is more likely to bend when the owner is looking for any other kind of accommodation, such as a delay in annual training or help with a transition to a different type of airplane.

We were also reminded that insurers have specific likes and dislikes.

As an example, the longtime insurer of a Beech Baron might not be the first choice if the owner is moving up to a Phenom 100 jet, no matter how long the company has insured the client in the Baron.

The downside of a long-term relationship—if it is not managed carefully—is that the insured can wind up paying more premium than he would if he simply bought the least expensive insurance each year. Our suggestion is that the owner make certain that his broker shops his insurance with all the companies that have the capacity to insure whatever he is flying.

If there is a less expensive but similar quote, everyone will know about it. If the current insurer can match a lower quote, the relationship continues. If the current company won’t bend, or is willing to reduce but not match their premium, then there is a decision to make. In this way, however, the aircraft owner has situational awareness of where the premium he is paying fits into the rest of the market. In most cases and especially in this market, very few companies will want to lose a good customer if they can avoid it.

And here we stress “good customer,” not one who bends the rules or falsifies information on the insurance application. Remember, while insurers don’t want to lose customers, they can cancel them.

One of the problems associated with changing insurers frequently is the fear of finding damage on inspection right after policy renewal. This is especially the case with turbine aircraft, where foreign object damage is found (to name one scenario), and it is unclear when it took place or which insurer should pay for it.

Promo Underwriting

While general aviation accident rates vary only slightly from year to year, the number of accidents is small enough that different insurers can have very different results for the exact same kind of airplane.

For example, one company could have half of all the Cirrus accidents that year, while another company had no Cirrus losses. While underwriters set their rates according to industry experience, their own loss experience will have a lot to do with which airplanes they are pursuing aggressively, and which ones they will reduce limits on. They might increase training requirements for them or cease to underwrite altogether. One of the hallmarks of a soft market is promotional pricing. Insurers will often offer rates that are below their costs in order to gain new customers. Other forms of promotional underwriting are unusually lax training requirements, or larger limits of liability insurance than the owner could buy normally. As owner, you may encounter all of these, given the increased number of insurers who are all trying to grow in a market whose customer base is aging and shrinking.

Insurance for transitioning pilots often combines all three of these soft market characteristics. Another benefit of using a broker who shops the market is that your broker can show you which companies offered a one-shot promotional price or higher limits two years ago and have not been heard from since. On the other hand, there could be a company that has provided lower quotes and higher limits for three years in a row and that should be seriously looked at.

Whether or not you decide to change underwriters to save money should depend on your situation. The loss-free 35 year-old-instrument- rated pilot of a Cessna 182 may always have companies who will offer him good insurance at reasonable prices.

The 70-year-old pilot of a PC-12 who carries $5,000,000 of liability coverage should probably give very careful thought before changing insurance companies. Pilots of rare or difficult to insure airplanes should also tread cautiously here.

Another tip from both underwriters and brokers that holds for both hard and soft markets is to make yourself as attractive a risk as possible. While underwriters look at what kind of airplane you fly, they spend more time looking at the main cause of accidents—the pilot.

Anything that you can do to make yourself safer is likely to help. Given the drop in hours flown in the past few years, we would recommend that pilots make some sort of annual training event part of their regimen.

What you choose will depend upon what you fly, but for most airplanes, an FAA WINGS phase is helpful. The type-specific training programs are we’ll respected, such as MAPA, COPA, BPPP, CART and CPA. And if you are flying a turboprop or a jet, an annual training event will be a must. Consider other types of training—like upset training—that aim squarely at the greatest single cause of fatal accidents.

Start Shopping

In general, our advice for pilots during this extended soft aviation insurance market is to make sure that your broker shops aggressively, but to change companies with care. At the end of this tunnel, insurance for your airplane will cost more and there will be fewer companies offering it.

The limits of liability that you carry now may not be available from all the companies that offer it now when the market turns, as it inevitably will. If someone is providing them to you now, it will be much more difficult for them to reduce them if you have been a long-term customer.

For pilots who are considering a transition up to a larger, faster airplane, there probably has never been a better time than now. Insurers are providing coverage for transitioning pilots under terms that many in the market have never witnessed before. Interest rates are low, and the price of many larger piston and turbine airplanes has never been lower. Even fuel prices are low, for a change. For the rest of us, let’s enjoy the insurance savings while they last.

Contributor Jonathon Doolittle is the principal of Sutton James Aviation Insurance in Hartford, Connecticut.