While the world of piston general aviation wrings its collective hands over an unleaded replacement for 100LL, the turbine market is caught up in a vast, breaking wave of biofuel activity. Even though heavily subsidized biodiesel is already finding a niche market, it looks like demand from the airlines, but especially from the military, is driving an explosion of so-called advanced biofuels development. As we reported in the December 2010 issue of Aviation Consumer, the ASTM approvals for bio-derived turbine fuels are already in place or soon will be. But thats not the same as having a ready and robust industry that can refine meaningful volumes of biofuels for aviation use at affordable prices. While research projects and startups number in the hundreds, no one has yet demonstrated convincing real-world economics that would allow biofuels to compete with petroleum-based fuels. And for every biofuel believer, there’s a show-me skeptic who notes that thus far, biofuels havent achieved a glorious history. Although turbine fuels are getting the big research dollars, there may be a minor spinoff that dribbles some crumbs to the piston side: Swift Enterprises continues its work on what is essentially an octane-proven 100LL replacement and a burgeoning biofuel industry can only help its efforts by establishing a wider technology base and, intriguingly, possibly benefitting from refining unwanted biofuel co-products into high-octane avgas. The Big Driver As has often been the case with other aviation technologies, the hard push for biofuels is coming from the military. The Air Force and Navy want to have half of their turbine fuel-and for the Navy, half of its ship propulsion fuel-coming from biomass sources by or before 2020. Both services will mix conventional fuels 50/50 with advanced biofuels in order to blend drop-in replacements that require no modifications to engines or distribution and storage systems. Rick Kamin, the Navys lead researcher for fuels, told us that this means an F-18 pilot launching on a mission with a blend of refined camelina oil and JP-8 wont know the difference. “To the fleet, its a straight drop-in solution. They wont have to make any changes,” he said. Testing has proven the point. Both the Air Force and Navy have done extensive testing on their proposed biofuels blends-including engine ground tests and flight tests-and found no surprises that required changes in fuel formulation. The Navy did its tests at Patuxent River, Maryland, in an F-18 it expansively called “The Green Hornet.” Heat contents and weights of these fuels are similar enough to require no performance table changes for aircraft. Kamin told us that seals, gaskets and O-rings in military aircraft do require a certain percentage of aromatic compounds to swell and seal correctly, but thats provided by the conventional petroleum portion of the mix. “That really is the main reason were going with a 50/50 blend,” Kamin told us. Although both services burn a bunch of JP-8 jet fuel, the military as a whole accounts for only about 2 percent of U.S. fuel consumption and the Navy only has a small portion of that. (Interestingly, by 2020, the half of its fuel consumption projected to come from biofuels is about 330 million gallons, only a bit more than general aviations current leaded avgas consumption.) Although thats a tiny drop compared to the 30 billion gallons of Jet A used in the U.S., the hitch is that the industry doesnt exist to make even that much turbine biofuel, nor are the technologies and economies anything like we’ll proven. The Navys purchase of a 40,000-gallon test batch cost the service $67 a gallon. Nonetheless, the services are undaunted. “We are very engaged with industry. Weve talked to private equity, weve talked to venture capital, weve talked to the firms in this area,” says Thomas Hicks, the Navys deputy secretary for energy. “We are confident that theyre going to be able to meet those demands and do so in the quantities we need at the price points we need,” he adds. The Navys schedule is aggressive, to say the least. By 2012, it plans to have all of its aircraft and ships certified to operate on 50/50 biofuel and by 2016, it plans to put an entire strike group to sea-the so-called “Green Fleet”-fueled by biofuel blends. Whats pushing the Navys conversion is whats always pushed alternative fuels: The promise of energy independence and some downside protection against petroleum price spikes. “Our goal in pursuing alternative and advanced biofuels really gets down to enhancing our energy security position, and having more independence as relates to the sources of our fuel. Today, we get our fuel from all over the globe and we want to have more sources of homegrown fuel to power the fleet,” Hicks told us. Worries about emissions are also a factor. In considering future fuel purchases, the services have to demonstrate that what they buy will have the equivalent or lower life-cycle carbon emissions than conventional fuels do.

What Is This Stuff?

For aviation use, advanced biofuels consist of several processes and a number of feedstocks, not all of them necessarily biomass. The term hydrotreated renewable jet fuel (HRJ)-sometimes also called synjet-can refer to fuels produced using a variety of processes. Hydrotreating, which is routinely done in conventional oil refineries, refers to exposing a hydrocarbon to heat and pressure in the presence of a catalyst to remove sulfur and other impurities. For HRJs, it is a principle part of going from raw oil to finished fuel.

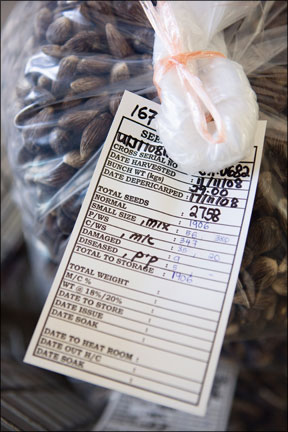

Feedstocks for HRJs vary but the two most promising seem to be camelina, an oilseed crop often grown in rotation with wheat and jatropha, a seed crop with a high oil yield. Because these crops yield oil directly which can be further processed, they are fundamentally different than corn-based ethanol, which requires water-intensive fermentation and distillation. The Navys Green Hornet test was fueled by hydrotreated camelina oil made by UOP, a Honeywell company.

Other processes are also on the table, including pyrolysis and liquefaction of feedstocks and some fermentation-based technology. One technology that gets a lot of press is the Fischer Tropsch process, which was developed in Germany toward the end of World War I and was used during World War II to synthesize liquid fuel from coal. But it can be applied to other feedstocks, including municipal wastes and even natural gas. Although Sasol, a South African company, uses F-T to produce liquid fuels from coal and natural gas, the Navys Rick Kamin told us the services havent been interested in this process because it doesnt meet the requirement to reduce carbon dioxide emissions. For the services and the airlines, the focus remains more sharply on crop-based HRJs.

Not So Fast

Given the volume of coverage and activity in the HRJ and biofuels fields, its tempting the assume the industry is on its way to being a player. After all, why would all these companies, not to mention the U.S. government, invest so widely without promise of success? For the same reason that in the late 1970s, Congress sold ethanol as the gateway to energy independence. It looked good on paper and it wasnt imported from the middle east. But there were skeptics then and there are skeptics now.

One of them is John Hofmeister, Shell Oils former CEO who, in retirement, has formed Citizens for Affordable Energy, a non-profit education and promotional organization. Hofmeister got the mainstream medias attention last fall when he declared that autogas in the U.S. would reach $5 by late 2011 or sometime in 2012, which could translate to $7 avgas. He says the demand curves are unmistakable as the world economy slowly begins to shake off the deep downturn of 2008.

“We are already at the demand levels of 2007 and 2008,” Hofmeister told us. “Asian demand is already exceeding those levels,” he adds. Following BPs Macondo oil spill in the Gulf of Mexico, offshore exploration permits have been sharply restricted, which Hofmeister says will deny world markets the stabilizing influence of one to three million barrels of crude a day from the Gulf. Unless demand relents, which Hofmeister doesnt expect, oil prices we’ll above $100-and probably closer to $150-may be sustainable.

We asked Hofmeister why this isn’t the perfect climate to launch a new biofuels industry. Maybe it is and maybe it isn’t, he says, because although biofuel processes are relatively straightforward to prove, the economics are anything but.

“When I was at Shell, I was involved in five different biofuels projects,” Hofmeister said. “Each one of them was promising, but as you go through these technical projects you set up gates that you have to go through. There was more of a tendency to move the gate than there was to achieve it.”

Hofmeister says he hasnt given up and thinks projects like purpose-grown algae for biofuels will have payback, but “that journey is long and torturous.” He says hell be surprised if the military services manage their ambitious goals. “The military has been at this for a decade. This is not something that started in the last two or three years. And they have essentially an unlimited pool of money to do things that are essentially non-commercial. If you look at the airlines or owners of private aircraft, theyre not going to be able to afford the kinds of things that the military is working on,” says Hofmeister.

The inflection point will be scalability, which everyone on both sides of the biofuels fence agrees is the next hurdle to overcome. Despite dozens of companies plying the field, Hofmeister thinks the industry is five to 10 years from having the knowledge-not the ability, the knowledge-to put large-scale, competitively priced biofuel production in place.

The rule of thumb is that harvesting and transporting the feedstock crop accounts for 80 percent of the production cost of biofuels. But unlike crude oil, which can be pipelined or tankered halfway round the globe without change or degradation, biofuel crops cannot, meaning that biofuel processing plants have to be placed near where the crops are grown. And there have to be a lot of them.

“A 65-million-gallon biofuel plant will need about 15 football fields a day of switchgrass to operate,” says Norman Smit, of the Biofuels Center of North Carolina, one of the few state-funded R&D shops for biofuels. Looking forward, North Carolina sees its tobacco crops losing value and its seeking replacements. Moreover, it has several major military bases that might represent a ready, local

market for a regional biofuels industry.

“You obviously cant afford to transport the crop very far,” he adds. And the comparison to the established economies of ethanol production is an imperfect fit.

“With ethanol, you had the Midwest corn infrastructure already in place. The transportation was there, the railways and the elevators…you don’t have that with energy grasses,” says Smit, who adds that largest challenge the industry may face is demonstrating the economics we’ll enough to attract funding.

“A bank can look at proposed numbers for a new ethanol plant and look at the ethanol market to see if the claims add up. Thats difficult to do with these new technologies,” Smit says. Thats why Smit says hes encouraged by the Department of Defense work, which might at least result in loan guarantees to leverage financing for new biofuel plants. The total market capital requirements are considerable because although there are about 150 oil refineries in the U.S., the non-transportable nature of fuel crops means that there may be several hundred if not several thousand biofuels facilities. The industry will require additional infrastructure that doesnt now exist.

A sustained oil price higher than $100 a barrel might ignite a flight of capital into the biofuels sector, but Hofmeister says that knife cuts both ways and has. “You reach a competitive price level where biofuels become affordable relative to crude oil, but then crude oil has proven over time that what comes up, will come down. The higher the crude oil price, the greater the political pressure to produce more crude oil.” He says the oil is out there and can be produced.

When and if that happens, says Hofmeister, biofuels are back where they started from: a bride looking for a groom.