Continental Motors got the attention of engine shops and owners last spring when it bought Danbury Aerospace, a manufacturing group that includes San Antonio, Texas-based Engine Components International, or ECi.

The acquisition was Continental’s third and caused a stir because it resulted in fewer choices and price competition in cylinders and components for Continental engines.

But Continental says the acquisition of Danbury’s assets (finalized this past summer) will bring plenty of new opportunities for a wide stretch of the market. This includes growth for ECi’s Titan engine line for experimental and LSA applications, added support for Continental and Lycoming engine overhauls, plus more momentum for its own line of engines and parts.

OEMs and engine shops seem to shrug off the recent acquisition, but based on our discussions with end users, in addition to feedback obtained from our recent cylinder satisfaction survey, it isn’t exactly being welcomed with open arms, but instead with guarded wallets.

A Growing Family

The logistics of acquiring a busy operation like ECi’s doesn’t come without at least some immediate consequence to the end user. We were alerted to more than one sizable wrinkle in the ECi acquisition when reader Roger Freedman dealt with work stoppage on the rebuilding of his Continental IO-360-ES crankcase. His local shop sent it to ECi’s San Antonio, Texas, location earlier this summer. After the case sat untouched for several weeks, Freedman said his shop was advised that ECi would no longer be performing case work on Continental engines and the component would have to be shipped elsewhere for the work.

What’s up with that? If Continental bought the assets of ECi, then why in the world couldn’t the newly purchased operation support a major component from one of its own engines, which happened to come off a Cirrus? Freedman told us DivCo, Inc.—the shop in Tulsa, Oklahoma, that ultimately repaired the case—is swamped with work that might have been accomplished by ECi.

Worth mentioning is that DivCo specializes in crankcase and sump repair for both Continental and Lycoming models and has been in business for over 30 years. It reeled in favorable comments in our last engine shop survey.

Continental’s Emmanuel Davidson said in a statement to Aviation Consumer that Freedman was simply unfortunate to be caught in the period of the ECi sale closing and resulting temporary work hiatus while Continental regroups and restructures the ECi operation.

“We have worked closely with our new team members to assess how to integrate the ECi business, operations and products into the operations of Continental Motors Group,” he told us.

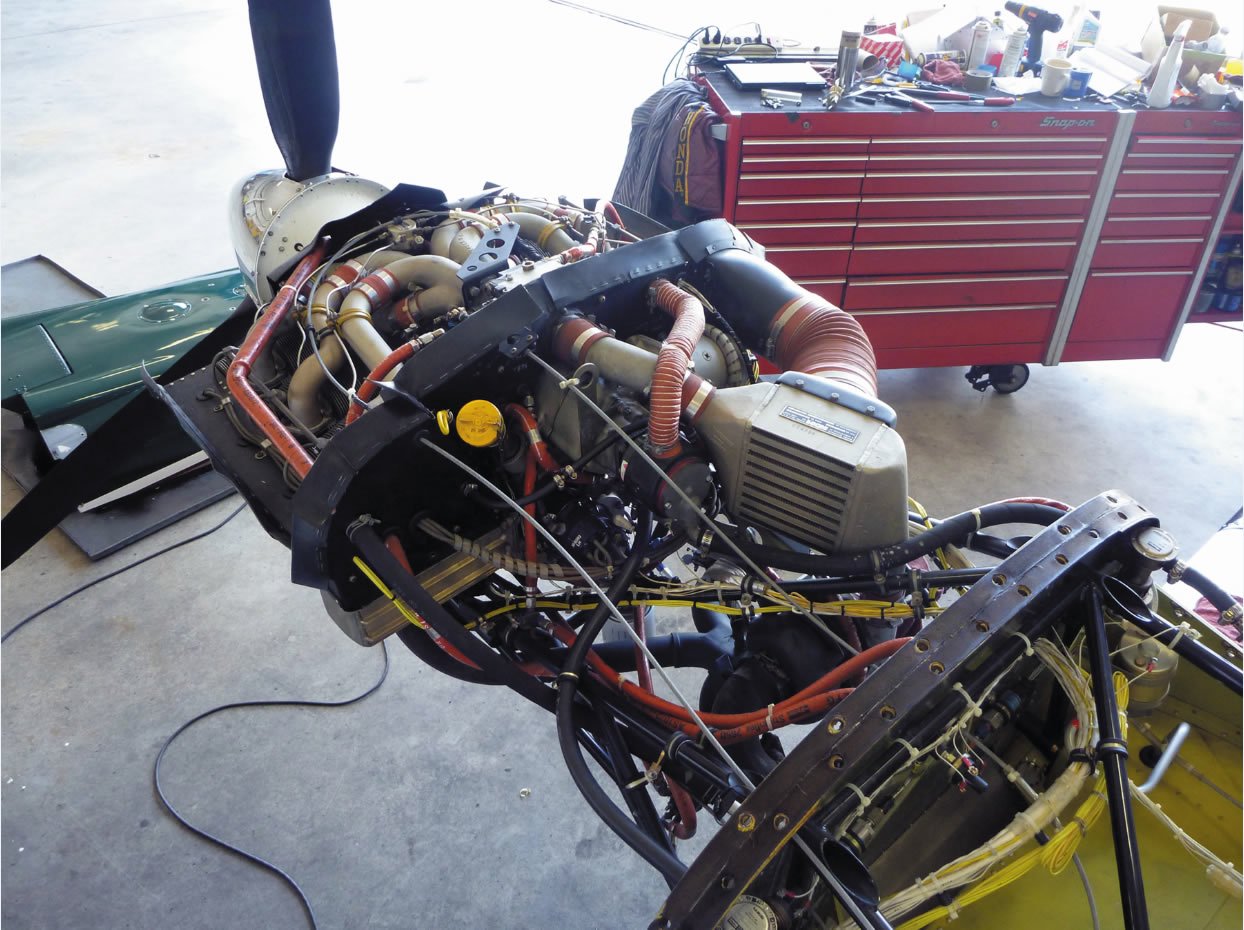

With ECi under Continental’s wing for a few months now (it acquired the assets and working intellectual property), while also hiring some (but not all) of the employees that used to work for ECi and Danbury, Continental said some of the product manufacturing and services offered by ECi will continue at the San Antonio, Texas, location. This is the manufacturing of PMA Lycoming parts to include cylinders, crankcases, crankshafts and pistons, to name a few. It also includes the Titan engine for the experimental and kit market. Additionally, Continental acquired the FAA repair station that Danbury used to operate, plus the Continental line of PMA parts. The Repair Station that tags along with ECi’s assets could be a sizable shot in the arm for Continental’s Fairhope, Alabama, facility—an already growing MRO that Continental has invested heavily in.

Consider that Continental overhauls both Lycoming and Continental engines in this facility, while also providing airframe and engine maintenance, in addition to avionics work.

As for the future of the ECi brand as the industry knows it, Continental told us that since it plans to eliminate some of the existing ECi product line, the long-established ECi brand will eventually go away. ECi has been an aftermarket supplier of aircraft piston engine parts since 1943, originally supplying jugs to U.S. armed forces during World War 2.

Got Nickel?

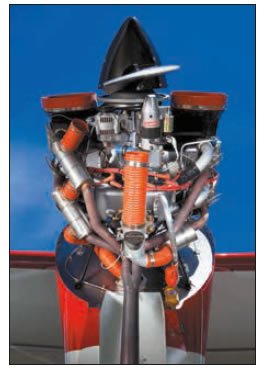

ECi, under the Titan brand name, is known for having the most complete line of replacement PMA cylinders for Continental and Lycoming engines. Additionally, ECi had an in-house cylinder overhaul program where cylinders were sent out with the proprietary Nickel+Carbide surface treatment. The idea here—which most shops we spoke with seem to agree with—is Nickel+Carbide cylinders could be the better choice for engines that don’t see regular use because the treatment provides a more corrosion-resistant surface than stock nitrading.

Part of the uproar surrounding the ECi acquisition is whether Continental will abandon ECi’s Nickel cylinders. Continental’s Davidson told us it will not abandon Nickel+Carbide treatment. As we go to press, pricing hasn’t been finalized, but Davidson said the company will offer the Nickel+Carbide coating process as an option on its existing line of factory cylinders for both Lycoming and Continental engines.

While reassuring for those sold on the Nickel+Carbide cylinder treatment, including major engine rebuilders like Waco, Texas-based RAM Aircraft (ECi’s major customer), fears of increased pricing loom. RAM provides engine overhauls, performance upgrades, new propellers and new and PMA-new parts for a wide variety of makes and models, specializing in twin Cessna models.

RAM—which deals heavily with Continental IO-520 and IO-550 rebuilds—has been an outspoken opponent of Continental’s acquisition of the Danbury family of businesses.

“In the simplest form, this comes down to the economics of supply and demand. There were only three sources for new cylinders for Continental engines, including Continental’s own factory cylinders, Millenium cylinders from Superior and ECi. It’s a narrow market and when you take one of the supply sources out, a constant demand will likely drive prices up,” said Thomas Dunn, RAM’s director of marketing.

It’s important to note that in a market faced with increasing prices for factory replacement parts, aftermarket companies like ECi invested sizable cost and effort to produce its own PMA replacement parts, providing decent amounts of competition and quality parts at more reasonable prices. This isn’t an easy task in a certification environment still bogged down with regulatory red tape.

On the other hand, reputable engine overhaulers—including RAM Aircraft—use parts from a variety of suppliers, including Continental factory parts. In our estimation, this means if you’re concerned that ECi’s buyout will create a void in the availability of quality parts, don’t fret. There are other suppliers and we suspect to see companies like RAM step up its effort to produce more of its own PMA’d parts, which is exactly what RAM is doing. While it might be a while before RAM can (or will) ever offer its own cylinders, in the absence of its Nickel line it is currently building its engines using a mix of Continental steel cylinders and Superior Millenium cylinders.

“Despite the ECi buyout, we’re plugging along without issues because we’ve never had all of our eggs in one basket. Our slogan has always been to use the best engine parts, no matter the manufacturer,” RAM’s Dunn told us.

RAM is among a growing number of suppliers with FAA ODA capability, or organization designation authorization. An ODA enables a company’s own engineering department to act as an extension of the FAA, with the ability to oversee its own product certification process. Ultimately, this can reduce the time it takes to bring a new product to market, while reducing costs.

Shops, OEM’s Neutral

An ECi product that Continental said it won’t abandon is the Titan X-series engines. These are non-certified clone engines built and delivered (fully assembled) around Lycoming’s architecture, to include the X320/340/360/370/540-series, and built by ECi using all factory-new parts (the F-series are Titan factory remanufactured engines).

The Titan line has leverage in both the LSA and experimental market. For instance, the 180-HP Titan X O-320 engine was a joint effort between ECi and CubCrafters (which funded much of the original development work) for its Carbon Cub LSA.

CubCrafter’s John Whitish told us the company has delivered we’ll over 300 of the Titan X340-series engine in existing Carbon Cub kits. When asked what the ECi acquisition means for CubCrafters—Titan’s largest OEM—moving forward, Whitish expressed some uncertainty, but was positive.

“Honestly, we don’t know. We’ve met with Continental’s management several times and remain optimistic that its experience and resources should bode we’ll for the Titan engine and for future development between companies,” Whitish said.

Whitish also noted that ECi’s product support got better and better over the years, meaning Continental will need to step up to maintain solid commitment to the sizable experimental/kit and limited, but maturing LSA market.

Vickers Aircraft recently selected the Titan IO-340CC for its Wave amphibian LSA, in development. Vicker, in part, credited Continental’s financial stability for the decision.

We spoke with a handful of engine and airframe repair shops, most of which took Continental’s latest buy in stride. Interestingly, when it comes to cylinders, some shops avoid the aftermarket entirely after dealing with one too many cylinder ADs.

Eric Santerre, the director of maintenance at VIP Aircraft Maintenance in Hartford, Connecticut, swaps his share of cylinders and maintains a loyalty to Continental and Lycoming.

“It’s a customer decision, but we don’t suggest any cylinder other than what’s offered by the engine manufacturer. Whether it’s a Continental or Lycoming, we give the customer easy options: we’ll either send the cylinder out for repair or we’ll buy new Continental or Lycoming cylinders. Sticking with the brand that made the engine has worked we’ll for us,” Santerre said.

“I’ll be sorry to see ECi’s Nickel+Carbide cylinders go away should Continental not adopt the process. I maintain some airplanes that don’t see more than 10 hours of operation per year. Those cylinders are good for combating rust. But I do worry about rising prices as yet another competitor goes away,” said Allen Goldman, an A&P in the northeast.

“In previous years we’ve installed aftermarket cylinders only to pull them off months later when an AD comes out. While the manufacturer may pay for replacement parts, it’s the customer that could pay big money for the replacement labor or early inspection effort (referring to FAA ADs issued against Titan cylinders),” said VIP’s Santerre.

More Pay To Play

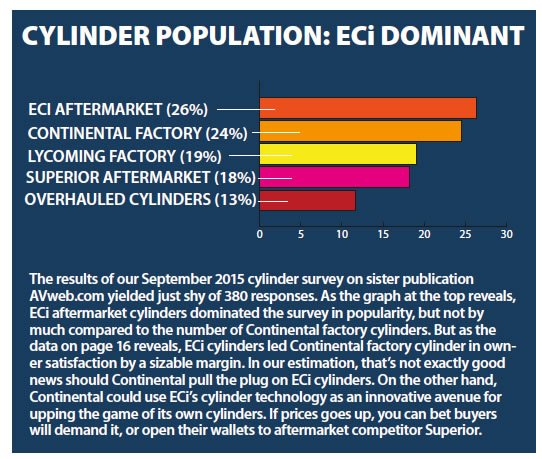

It’s too early in the game to predict precisely what impact Continental’s acquisition of ECi will be to the market after removing a major competitor over a range of products. As we explain in the cylinder survey summary on page 16, many buyers are convinced that prices will be on the rise—a logical prediction.

On the other hand, like other businesses facing trouble, we wonder if ECi’s demise was inevitable. There have been rumors that ECi was facing financial issues due to slowing sales, higher costs and a down economy.

But without seeing its financials and its exact profit margins, we can’t confirm if its business model (which included a long-standing and sizable relationship with RAM Aircraft and CubCrafters) was sustainable or not. At this point, it just doesn’t matter.

What does matter is how Continental will structure its own product line, the acquired ECi product line and the decisions customers will make when faced with buying a Continental product.

In a recent interview with Aviation Consumer, Continental Motors’ Rhett Ross was forthcoming, while recognizing there still is at least some competition.

“Yes, Continental is becoming proactive and prices have risen closer to a factory price model because one of the sources of supply (meaning ECi) is out of the market,” he said.

Ross reiterated there still remains competitor Superior, while companies like Kelly Aerospace and Hartzell are involved in their own PMA process to ensure there is a competitive spirit in the market.

While cautious not to badmouth any competitor involved in an alternative PMA parts manufacturing program, Ross pointed out that many PMA programs are built around an incomplete product cost structure.

In other words, it’s the OEM that makes up the difference by carrying the costs of new product design and product liability, while also picking up slack when it comes to product innovation.

It’s clear to us that Continental won’t retain some—if not many—of the existing ECi products, but some acquired products will get a new lease on a better life. This includes the experimental Titan engine line and more products for both Continental and Lycoming applications.

The way we see it, if ECi was in financial straights as speculated, its acquisition by a financially stable and competing Continental Motors should hardly come as a surprise. For aircraft owners, it’s yet another cost hike in a declining market.