If Oshkosh is to airplane companies what Wall Street is to investors, the mood in the world of general aviation is upbeat bordering on ebullient. At EAA AirVenture 2007 we saw a bumper crop of new product introductions-major and minor-at a well-attended show that may signal a turning point of sorts. Thats especially true for the emerging Light Sport Aircraft category, thanks to both Cessna and Cirrus announcing full-blown LSA programs which send the unmistakable message that they finally take this idea seriously. There were lots of hey-did-ya-see-that moments at AirVenture, but the biggest came from Eclipse, which flew in an intriguing single-engine “concept” personal jet that it claimed to have built in about 200 days in an off-site skunk works in Virginia. We werent entirely surprised by this, given persistent rumors of Eclipses plans before the show. But the fact that Eclipse CEO Vern Raburn actually taxied the thing up to the Eclipse exhibition was a stunner that were sure got the attention of Diamond, Cirrus and Piper, all of whom are toiling away on single-engine jets of their own. True to form, OSH also proved the venue for avionics introductions, including a new aftermarket glass cockpit suite from Bendix/King, a datalink weather box from Avidyne and a low-cost glass system from Aspen Avionics that may finally make this technology affordable to the Toyota Camry set. Increasingly, the glass display field is looking like the LSA segment, with an abundance of products that may or may not find legs in the market.

Eclipse Solo

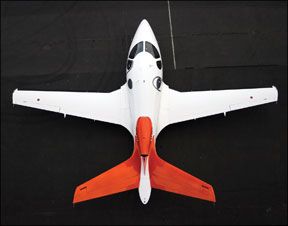

Give Vern Raburn credit for one thing: The man is a showman. If his intent was to lock up every lead story for AirVentures opening day-mission accomplished, complete with flight suit. Raburn arrived in style in the new Eclipse concept jet, a diminutive four-seat single-engine design thats a combination parts-bin/clean sheet idea owing inspiration to the twinjet Eclipse 500. Ahead of AirVentures opening day, we knew the project was afoot, but it was uncertain whether it would arrive in mock-up form or as a flyable prototype.

Eclipse thinks the time is right to sink exploratory dollars into a single-engine jet, even at a time when its principle program-the 500 twinjet-continues to suffer production and technical delays. The new airplane is being pitched like a Detroit

concept car, a trial balloon to test the market for what is essentially a sport jet. It uses the Pratt & Whitney PW615F 1100-pound engine found in the 500 (top mounted above the cabin) and is built both of composite and metal, with thrust directed between a V-tail similar to the idea Cirrus is employing on its single-engine jet.

The demonstrator-which, to our eye, looked cleaner and more carefully detailed than some of the production 500s on display-was built by Swift Engineering in Wallops Island, Virginia, rather than at Eclipse headquarters in Albuquerque, New Mexico. Were told that only a handful of Eclipse staffers knew of its existence and that it first flew on July 2.

Projected cruise speed is 345 knots at 35,000 feet with a 1250-mile range and 2000-pound useful load. No firm prices were given nor even an intent to produce it, but the back-of-the-envelope estimate hovers around $1 million. The airframe is nicely proportioned and good looking from every angle, in our view, but the sweetest spot is the cockpit ergonomics. The airplane sports a three-screen Avio NG panel with a retractable keyboard and a center console, with a rheostat knob for a throttle rather than a lever.

If Eclipse builds the single, it could leap past Cirrus and Piper, at least, in the single-engine jet market, with each of those companies countering that theyre fishing in different markets. (Competitors caught flat-footed always say that.) On the other hand, for as brilliant as Eclipses concepts are, the company has proven less adept at executing its ideas at a pace customers might remotely relate to a bankable schedule. And speaking of customers, we wonder how thrilled Eclipses current position holders are to see the company devoting resources to a new airplane when theyve been waiting years for the 500 twinjet. (http://www.eclipseaviation.com/)

Awash in Glass

Part of Eclipses problems have been related to its ber-integrated Avio glass panel system, which it continues struggling to make fully functional. Meanwhile, for those

of us in shallower water, AirVenture 2007 saw significant developments in affordable aftermarket glass. The two notable players are Bendix/King and Aspen Avionics-and the smart money is on Aspen for rapid delivery.

Were not sure why no one thought of this before, but Aspens idea is to replace steam gauges with EFIS modules that fit into roughly the same holes, complete with onboard ADAHRS and redundant, self-contained battery backup. Heres the concept: Remove your steam AI and HSI/DG and insert a single deeply vertical EFIS screen that replaces both instruments. Retain the pitot instruments to either side and/or replace them later with modules from Aspens evolving product line, called-appropriately enough-Evolution. Prices, says Aspen, will start at $5995 for the PFD and $4995 for iterations of an accompanying MFD. (http://www.aspenavionics.com/)

Aspen hopes to have an initial module ready for sale by late 2007, with more variants to follow later. If they make that schedule, theyll beat the Garmin G600 to market by six months. Garmin may be actually feeling heat from emerging competition or it just wants to move boxes to get the G600 out of the shade. It announced a $2500 rebate program for the G600 if customers also purchase a pair of GNS430W or 530W navigators at the same time. (www.garmin.com/)

More competition for Garmin comes from Bendix/King with its own high-dollar aftermarket EFIS system intended for light aircraft. The new KFD840 is a self-contained PFD designed to replace an entire mechanical six pack, while the KSN770

is really a state-of-the-art single-radio navcomm that doubles as a PFD. (Think Garmin GNS530.) Tentative prices are in the $20,000 range for the PFD and competitive prices for the MFD, which we take to be about what a Garmin GNS530W costs. (http://www.bendixking.com/)

Deliveries are projected for mid-2008. But one avionics shop owner we talked to rolled his eyes at that schedule. Although Bendix/King still enjoys terrific product recognition among buyers, shops are widely skeptical of the companys commitment, given slipped schedules and lack of new products. If Bendix/King wants to be taken seriously in the aftermarket, it will need to meet delivery promises with no excuses.

Meanwhile, Avidyne (http://www.avidyne.com/) follows its usual habit of zipping the lip until the product is almost ready to ship. It announced two products that incrementally add to its emerging line. Working with WSI, Avidyne has developed a new Sirius Radio-based weather datalink receiver that WSI will use to replace the ill-starred AV-100 and AV-200 boxes that left many customers beached when the satellite technology proved unequal to the task. Avidyne will provide the AV-300 (data only) and AV-350 (data and Sirius audio) for WSI and also sell its own version of the same box-the MLB700-to play on Avidynes EX500 and 5000 MFDs. WSI expects to ship in August at $4347 for the AV-300 and $5949 for the AV-350. Its offering a transition/rebate program for AV-100 and -200 owners that basically gives them the AV-300 for free if they agree to sign up for a year of WSIs weather service. Its a good deal and fair penance to the market, in our estimation. Avidynes versions, for display on its MFDs, will sell for $5495 and $4745. Mid-August shipments are expected.

WSI may have an uphill fight to recover marketshare lost to XM Radio-based systems from Garmin. Many AV-200 buyers felt burned by WSIs abrupt termination of its previous program and may be reluctant to expose their wallets a second time.

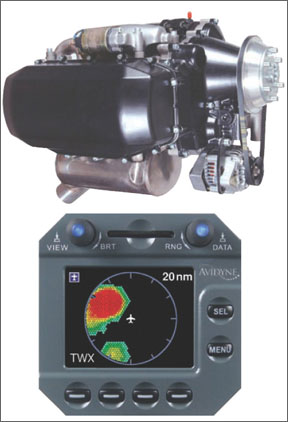

Avidyne also announced a new lightning detection system to compete with L-3s venerable Stormscope. The TWX670 offers new technology to provide more accurate in-close ranging, according to Avidyne. Price and availability will be announced later.

Not that L-3 is snoozing, by the way. If you havent quite overdosed on glass technology, wait a couple of months and you’ll see L-3s new SmartDeck suite, which appeared at OSH under the Goodrich banner a few years ago. (See http://www.l-3com.com/) We know the system is being tested in a Cirrus and that it incorporates something the other offerings don’t have-forward-looking infrared for night and low-vis operations. Look for a report in three or four months.

Light Sport

The new definition of utter futility is trying to keep all the Light Sport aircraft sorted out-you can hardly park a golf cart around OSH without bumping into another one. We can predict with confidence that two will sweep aside at least some of the emerging mass of LSA gnats-Cessnas just-confirmed Skycatcher LSA and a newly announced entry from Cirrus, which is partnering up with a German company called Fk Light- planes thats been building microlights for the European

market for years. (www.fk-lightplanes.com/)

The Cirrus LSA will be a shake-and-bake project thats a retool of Fks existing Rotax-powered Fk14 Polaris micro into the Cirrus SRS. Consistent with the Cirrus ethos, the Polaris/SRS is a composite low wing and will sell for something like $100,000. Cirrus CEO Alan Klapmeier says the Cirrus mission has always been to make flying more accessible and LSA is part of this. We doubt if many LSA buyers will be customers for Cirrus SR20s and SR22s, but a few might be and, in any case, the SRS could serve a trainer role for the expanding Cirrus empire, which will soon get a run for its money from Cessna.

Although this looks to us like a me-too business decision, Cirrus is smart to do it out of house, conserving its resources for its emerging light jet and other projects. The Polaris is not currently LSA compliant and Cirrus estimates it will take a year to get it there. (www.cirrusdesign.com/)

If Cirrus has a promising future in LSA, Cessna is working on owning the market. Shortly before the show, it announced the green light for its Skycatcher O-200-powered LSA. How confident is Cessna of the market? Confident enough to know that hundreds of buyers were waiting to pounce as soon as Cessna declared its intent to move on LSA and confident enough to show up with an electronic ticker recording the number of non-refundable $5000 deposits against the airplanes $109,500 selling price. By mid-week, the ticker was clicking past 440 orders-thats more than $2 million and Cessna is nearly two years from delivery. A Cessna booth dweller told us despite the brisk demand, its unlikely the company will accelerate deliveries by much.

We sat in what Cessna describes as close to a frozen design for the Skycatcher-who decided on that name, anyway?-and we liked the center sticks, the wider-

than-a-150 cabin and the Garmin G300 dual screen EFIS setup. Its a tight squeeze to ingress, however, which is something LSA owners will have to get used to. (www.cessna.com/)

Powerplants

For every why-didnt-I-think-of-that idea that appears at OSH, there’s one dingbat notion to serve as offsetting ballast. This year was no exception and, God help us, we think two of the wackiest might not be so crazy after all. Both involve powerplants.

Sonex-a long-established kit supplier- and AeroConversions Products showed what may evolve to be a realistic electric-powered aircraft. Its basically RC technology scaled up, with an 80-HP brushless cobalt magnet electric motor about the size of a small wastebasket and a giant pack of lithium polymer batteries. Sonex hasnt flown the motor yet and is viewing the so-called E-Flight project as a technology demonstrator. On paper, the motor looks like it could drive the Sonex two-place Experimental at over 100 knots, possibly for up to hour or so. The idea has some hurdles to overcome, not the least of which is containing the scary amount of energy stored in those batteries-up to 200 amps.

So, why don’t we think this is a dingbat idea? Because high fuel prices and an emerging swing toward LSA airplanes may mean that many owners will fly their airplanes on short joyrides, not urgent-schedule cross countries. So a 45-minute ride on battery power with a 24-hour recharge cycle may make perfect sense. With fuel prices a growing concern, this technology could prove promising. Even if this E-flight project never flies, its a start. (http://www.sonexaircraft.com/)

Aero-diesel engines have already established themselves, but now comes an interesting one from a UK company called Powerplant Developments. It proposes to resurrect the two-cycle diesel design pioneered by Junkers in the successful World War II Jumo 200-series engines. The so-called Gemini 100 diesel has three cylinders, each with two pistons in the same bore operating toward each other. Two crankshafts mounted where the cylinder heads are on a conventional gas engine are geared to a single output shaft.

Powerplants engine would weigh about 155 pounds all up with liquid cooling and produce 100 HP. Again, what makes this long shot interesting is that its proposed for the LSA market, so the company can avoid a high-dollar certification effort that would make it unmarketable. Powerplants Derek Graham told us the UK and Europe arent leading the charge toward diesels in general, but are being dragged toward more efficient engines by market realities.

And speaking of market realities, Continental Motors hasnt found same very kind to its Aerosance-developed PowerLink FADEC, which has been market ready for five years but has found few takers. The good news for TCM is that Diamond will use the new IOF-550-N in its five-place cruiser, the DA-50 SuperStar.

Further, TCM is pursuing its own STCs to convert early Cirrus SR22 airframes to the new FADEC engine. This installation is being called the Alpha engine and the idea is that the FADEC and its associated electronic monitoring will provide nearly real-time maintenance monitoring, making it possible to extend TBOs and improve the overall owner experience. Frankly, were happy to see this turn of events. The Aerosance system has been in for plenty of criticism and these two developments may get enough engines out there for it to prove what it can do.