As a concept, Americans love diesel engines. After all, this is a country that has devoted an entire sub-genre of music to guys with chain-drive wallets and baseball hats with Cummins logos.

But just try to buy a new car with a diesel engine. A light truck, sure, a boat maybe. But a car? Forget about it. Diesels are noisy, stinky and slow and, oh, by the way, if you insist, Volkswagen can get you into a nice diesel Jetta for a $1500 price premium over the equivalent gas model. Somehow, paying more money to make noise, smell bad and go slower hasnt proven to be a slam-dunk formula for sales success in the U.S.

And now along comes general aviation-an industry that has raised boneheaded marketing decisions to a veritable religion-with plans to build diesel-powered light aircraft. Are these guys nuts?

Maybe. Maybe not. With the industry generally nervous about the continued availability of 100LL-or any practical avgas, for that matter-diesel technology like that being proposed for Diamonds new DA42 Twin Star, has an undeniable appeal.

Avgas is ruinously expensive outside the U.S., if you can get it at all, while Jet-A is widely available and cheaper.

In the automotive and truck world, diesels have terrific fuel specifics and heroic longevity, which is why diesel-powered cars enjoy a 32 percent market penetration in Europe. (In the U.S., diesel cars account for less than 1 percent of sales.)

Were aware of a handful of aircraft diesel initiatives and although these look good on paper, closer examination reveals some shortcomings, not the least of which is that in airplanes, diesel fuel specifics still have to be proven to be better in the real world and the engines themselves may be more expensive to produce.

At this juncture, were happy to see diesel experimentation. But we think given the enormous costs of development, possible price premiums on some-but not all-the engines and the fact that gasoline engines are, in the end, relatively efficient, the chances of success in the U.S. market are hardly assured.

Whos Got What?

It should be no surprise that Europeans are leading the charge in light aircraft diesel. At least two companies have diesel designs flying and were told that a third may be in the wings.

The two leaders are SMA, a French consortium and the Thielart Group, a German company which, heretofore, has specialized in auto racing technology and advanced piston-engine electronic controls.

SMA is held by three partner companies, EADS, Renault and SNECMA, the latter best known for its jet engines for military and for civil transports.

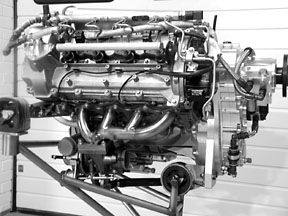

In Europe, SMA has certified the SR305, a four-cylinder, 230 HP direct-injection turbocharged diesel intended for the four-place aircraft market. The engine is air cooled and its weight-per-horsepower is comparable to gasoline engines of similar power. It has single-lever control and full authority digital engine (FADEC) control with pure mechanical reversion; it requires no electrical source to operate the engine if the FADEC fails. The targeted TBO for the SR305 is 3000 hours.

For marketing purposes, the companies associated with this and other diesel engines prefer to call it a Jet-A engine, thus distancing it from the smudgy image diesel cars and trucks seem to suffer in U.S. and conferring upon it, at least in name, the panache of turbine technology.

SMA has flown the SR305 for some 1000 hours in Socata TB20 and Seneca testbeds. It claims a fuel efficiency in the range of .35 BSFC (more on that below) with a direct operating cost reduction of 40 to 50 percent.

The engine is far enough along to have attracted the attention of several manufacturers, including Socata, Maule and Cirrus. Maule expects to have a prototype powered by the SR350 flying by this fall while Cirrus appears less committed to a schedule, if not the concept, its diesel will be called the SR21tdi and will sell for a price premium over the gasoline powered SR20. Socata, obviously a launch customer, will offer the SR305 in the TB20.

The Thielart Groups TAE 125, a 135 HP turbocharged diesel, was a surprise guest at EAAs Oshkosh AirVenture last summer but even by the time we learned of it, Thielart claims it had accumulated about 1000 hours of flight time in testbed Cherokees and Cessna 172s.

The TAE 125 is a turbonormalized, watercooled design based on a Mercedes-Benz automotive block. Like the SMA SR305, it has FADEC and a single-lever control. But the FADEC is all-electric and requires a dual battery back-up reversion system.

Claimed fuel economy is in the .32 BSFC range and Thielart says the TAE 125-although only 135 HP-compares directly with Lycomings 150 HP O-320, reducing overall direct operating costs by an eyebrow-raising 70 percent.

Thus far, Diamond has flown a TAE 125-equipped DA40 Star and will use the engine in its soon-to-be DA42 Twin Star. In the U.S., Superior Air Parts is marketing the TAE 125 for experimentals and, eventually, as an STC replacement engine for aircraft in the 150 HP range. Under European JAR-E specs, Thielart has already obtained certification and the company tells us it expects FAA validation later this year.

Closer to home, Continental continues its development on the so-called GAP engine developed under a grant from NASAs General Aviation Propulsion project. The Continental is a four-cylinder turbocharged design that appears to be a long way from certification but is reportedly flying in a Skymaster. Despite repeated phone calls to Mobile, Continental declined to offer any information about the engine.

Other entries in the diesel field include the perennial favorite, the Zoche line. Since as long as anyone can remember, German engine developer Michael Zoche has displayed his unique symmetrical radial two-stroke diesel radials at Oshkosh.

They appear to run like watches with actual or proposed horsepower ratings between 70 and 300 HP and BSFCs at a believable .346. Although Maule told us they were interested in test bedding the Zoche diesels, they could never convince Zoche to deliver a prototype, much less a certifiable engine.

More recently, a cottage start-up, DeltaHawk Recreational Diesel Engines, has been developing two-cycle V-4 diesels at 160 and 200 HP which have been running on the test stand for a couple of years and, says DeltaHawk, will soon fly. These are intended for the experimental market, at least for the time being.

Notably missing: Lycoming. At Oshkosh three years ago, Lycoming announced a partnership feasibility program with Detroit Diesel, a leading U.S. manufacturer of truck and industrial engines. Evidently the two companies didnt see enough market to interest them for the project has been quietly dropped.

Pros and Cons

As noted in the DA42 TwinStar sidebar, the diesels siren song is fuel availability and economy, and in that order. Worries about continued avgas availability appear to be the prime driver for the latest round of diesel development; efficiency and lowered operating costs are icing on the cake. (If there is a cake.)

Aviation Consumer wrote its first the-sky-is-falling-100LL-will-disappear article two decades ago and weve been printing-if not believing-the EPA/FAA line ever since. No, no, this time we really mean it, says the industry. Avgas-at least the 100LL version of it-will soon disappear while lead-free Jet-A will remain widely available and less expensive.

The impending extinction of 100LL has spurred intense research in alternative fuels and in ignition systems that will make it possible to burn lower octane gasoline without worrying about detonation. In that context, the resurrection of aero diesels is just another option.

Because of the high compression involved-as high as 19 to 1-diesels have traditionally been built stoutly, leading to another problem for airplanes: weight or, more to the point, specific weight. If this was a problem for early aero diesels, it seems to have been tamped down in modern designs.

SMAs SR305, for example, has a claimed specific weight of 2 pounds per HP, the Thielart TAE 125 claims 2.1 lbs/HP while a Lycoming IO-360 is 1.6 lbs/HP. (How the engine is dressed affects these figures somewhat, of course, details that cant yet be predicted accurately.)

Just as important-at least in the view of diesel acolytes-is that diesel technology has improved dramatically since the early 1980s. That wise crack we made about diesels being noisy, slow and stinky? We lied. It was true 20 years ago but its no longer true. Thanks to improved direct injection, sophisticated turbocharging and FADEC systems, modern automotive diesels-mainly from Volkswagen and Mercedes-Benz-drive more like gasoline engines, with sprightly acceleration, sociable emissions and, best of all, impressive economy. Leading us directly to aero diesels best hope for a foothold in the U.S: operating economy.

Efficiency Claims

To hear SMA and Thielart tell it, the aero diesel should substantially reduce aircraft operating cost by dint of greater fuel efficiency and lower maintenance costs, both because a diesel has no ignition system and because TBOs are projected to be as great as 3000 hours.

Consider the fuel efficiency first. The underlying truth is that Jet-A proposed for use in aero diesels contains slightly more energy than avgas: about 22,000 BTU/pound for Jet-A versus about 20,000 BTU/pound for avgas. The fact that Jet-A is between 10 and 20 cents cheaper than avgas in the U.S. means that Jet-A enjoys a 20 to 30 percent cheaper cost-per-BTU than avgas.

The best measure of an engines relative efficiency is brake specific fuel consumption or BSFC, a ratio of fuel burned per hour per unit of power. The lower the BSFC, the better the efficiency. Typical GA piston engines deliver cruise BSFCs in the .40 to .45 range.

But the problem with BSFC is that it can vary widely with operating environment and, especially in gasoline engines, with leaning state and induction design. When diesel and gasoline engine BSFCs are compared, be wary of both the operating state and whether the engine is carbureted or fuel injected, normally aspirated or turbocharged.

For example, aero diesel BSFCs are typically quoted in the mid .30s, a value thats credible, in our view. SMA says its SR305 230 HP diesel, for example, will have a BSFC .35 at 200 HP. On the other hand, on Thielarts Web site, the company compares its TAE 125 diesel with Lycomings O-320, both of which have flown in a testbed Piper Warrior.

At a claimed equivalent airspeed of 105 knots for the Warrior, Theilarts derived BSFC for the Lycoming O-320 is .45 while it claims .32 for its TAE 125 diesel. Were all cheery about diesel efficiency but call us skeptical of that number. The very best BSFCs for diesels are as low as .28, delivered by massive slow-turning marine diesels that are a far cry from high RPM aero diesels. We would like to see some real-world data before accepting such claims.

Indeed, even SMAs claims may be coming down to earth. Maule told us it expects fuel flows on the SR305 in the 10 GPH range rather than the 8 to 9 GPH it had originally hoped for. Still, thats an improvement over the 12 to 13 GPH soaked up by the Lycoming O-540 series used in the Maule M-7. (The large displacement Lycs have BSFCs in the mid to high .40s.)

Peter Pierpont, who oversaw a research project to test fly an SMA SR305 in a Cessna 182, believes the fuel economy claims are realistic. On a demonstration flight between Daytona Beach and Oshkosh, he recorded fuel flows of 9.5 GPH at a power output of 200 HP. A back-of-the-envelope calculation reveals a .32 BSFC.

Worth noting is that with canny manual leaning, gasoline engine BSFCs in large displacement Continental engines can be driven down to the .38 range in engines thus far capable of producing more raw power than any of the aero diesels, although with less impressive torque output.

Thielart compares its lofty .32 BSFC for the TAE 125 BSFC with a carbureted Lycomings four banger but the injected version-the IO-360-can manage a none-to-shabby .40 at best economy leaning.

Thielart has taken some jabs for claiming its 135 HP TAE 125 is the equivalent of a 150 HP Lycoming O-320 and Frank Thielart admits that this is hard to understand, even for us.

He says the diesels static thrust is greater because a larger diameter three-blade prop is used, turning at lower RPM, while the engine runs at slightly higher RPM. Not having flown a Thielart-equipped aircraft, we cant verify the claim by observation but Diamond tells us that two identical DA40s-one with a Thielart diesel, the other with a Lycoming IO-360, showed similar takeoff performance. The IO-360 initially outclimbed the diesel but the diesel caught up as the Lycs power fell off above 5000 feet.

We suspect we’ll get our chance to verify these claims soon enough for Thielart has ambitious plans to market his engines and has a 310 HP model in development.

Terrific TBOs

Over-the-road diesels are renowned for longevity, easily racking up 300,000 miles with no overhauls. The emerging aero diesel world hopes to do the same but the barriers to success are daunting. Because of their high compression, peak cylinder pressures in diesels are astronomical: 2100 PSI or more compared to 800 to 900 in gasoline engines.

In engines designed for land vehicles, those pressures are easily contained by additional structure, which translates to weight. Aero diesel designers don’t have that luxury, thus the structure has to be strong enough but not too strong. Although the aircraft diesels have racked up impressive test stand hours, the true measure of their durability will come with hundreds of thousands of hours of real-world flight time.

Of major concern is what engineers call torsionals, the terrific wallop transmitted down the power line as each cylinder fires and reaches peak pressure, putting enormous load on the crankshaft and prop.

Frank Thielart admits that this is a concern: This is why we decided on a gear box with a torsional damper. I don’t see any other way to do it, he told us. The TAE 125 has a 1 to 1.69 reduction gearbox, which also allows it to operate at lower boost pressures.

On the other hand, geared gasoline engines have proven to be maintenance hogs, so nothing comes without a price. The SMA SR305 is direct drive; no gearbox. But it needs substantially higher boost-as much as 90 inches-to produce power comparable to gasoline engines.

Thielarts initial TBOs are proposed to be 2400 hours, eventually reaching 3000 hours. Actually, the Thielart engines have no TBO but a TBR. The company wont authorize overhauls at all; when the engine times out, its scrapped and replaced with a new one.

Engine overhauls take a lot of money, reduce reliability and the used parts cant be checked we’ll enough, says Thielart. Currently, Thielarts list price on a new TAE 125 is $19,500 complete with all accessories, including a new cockpit power gauge system. An O-320 overhaul, by comparison, costs about $16,000 while a factory-new engine lists for $25,578, including core exchange.

The SMA SR305 will list for about $80,000. A high price, yes, but hardly unheard of, since some new high output Lycoming gas engines cost as much. On a per hour basis, Thielarts numbers are intoxicatingly low if it delivers on a 3000-hour TBR: $6.50 per hour engine replacement reserve versus about double that for a new Lycoming equivalent. The SMA engine comes in at a less impressive $26 per hour.

Conclusion

What does all this mean? Thanks to vanishing avgas in Europe, the SMA and Thielart engines are real projects that appear to have serious legs and already some takers on the airframe side. In our view, the economy claims of diesels are a given, although they may be overstated for GA applications.

In the U.S., the market has historically not been kind to revolutionary engine initiatives. Otherwise, we wouldnt be flying behind essentially the same iterations of gasoline engines pioneered in the 1950s and 1960s. That means diesels will have an uphill fight against the entrenched installed base of Lycoming and Continental engines which we all love to hate but that often don’t work as poorly as we think.

One engine expert we spoke to calls emerging diesels standby technololgy, meaning that until existing gasoline engines begin to look economically unattractive, diesels will be waiting in the wings but enjoying only an early-adopter market share until then.

Clearly, the availability of avgas drives the future of diesels in the U.S. If the stuff truly is phased out, the technological square off will be between FADEC-equipped gasoline engines capable of burning low-octane fuel and diesels capable of burning Jet-A.

We predict that gasoline engines will enjoy dominance for the foreseeable future but the more pressing question is whether it makes sense to convert an airplane once the STCs become available.

Thus far, the numbers arent compelling. The 230 HP SMA SR305 lists for about $80,000. Even if that price includes the STC and labor, its hardly competitive against a conventional overhaul for an equivalent gasoline engine.

Maule tells us that its proposed diesel-powered M7 will carry about a $50,000 price premium over the gasoline powered model. It will have longer range, somewhat more speed and should be cheaper to operate than the gasoline variant. Were not sure how U.S. buyers will react to this but were certain Maule will find enough customers in Europe and Africa to make the project worth the risk.

Thielarts numbers are more attractive at this point. If you can re-engine a Warrior or Cessna 172 for a small premium and gain additional range and speed with reduced operating costs, whats not to like?

But what all the diesel makers have to prove above all is that they can meet gasoline engine dispatch reliability and TBO runs, let alone exceeding them. And if they then follow-up with reliable, cost-effective high output diesels, Jet-A may yet become the dominant fuel on every GA airport. But there’s a long haul ahead to get there.

Also With This Article

Click here to view “Checklist.”

Click here to view “Aero Diesel Specs At A Glance.”

Click here to view “History Repeats.”