The COVID-19 pandemic—with resulting supply chain and workforce problems—surely changed the light aircraft maintenance service industry for the worse. Parts and technician shortages have created long scheduling lead times and a sharp rise in labor rates, and aircraft are sitting on shop floors for much longer than anyone wants.

Moreover, some shops are dissing lower-end aircraft and focusing on high-dollar turbines. A friend who had the same shop wrench his Piper Cherokee for the past 25 years was told it would no longer work on it. So much for customer loyalty.

Whether you’re new to aircraft ownership or been at as long as me, now is a good time to have a Plan B when it comes to maintenance.

BOOTED OUT OF ANNUAL

Based on 2022 data, in the U.S. there are 357,903 certified A&Ps and Repairmen, with 9875 new certificates issued in 2022. The FAA reports that GA and Part 135 airplanes and rotorcraft totaled 209,195 for 2021. The stats on the surface suggest there are 1.7 mechanics per aircraft. Like most stats, the devil’s in the details behind those numbers.

Not all of the 357,903 issued certificates are actually working mechanics. In 2021, there were 3133 MRO (maintenance, repair and overhaul) businesses in the U.S., and the number doesn’t include sole proprietors working out of small hangars. The U.S. Bureau of Labor Statistics reports that as of May 2022, there are a total of 134,070 AMTs (aircraft mechanics and technicians) and 20,200 avionics technicians (totaling 154,270). The USBLS projects there will be roughly 13,100 openings for aircraft and avionics mechanics and technicians over the next decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, including death and retirement. In essence, it’s difficult to quantify the problem. But it’s a problem that can hit your wallet.

In his Booted Out of Annual webinar, Mike Busch at Savvy Aviation reinforces what a lot of aircraft owners are dealing with. Some shops are booking their GA customers’ annual inspections one year out, some shops have a three-month lead time for prepurchase inspections and some factory-rebuilt engines can take nine months for delivery. We’ve heard of longer wait times.

In the webinar, Busch discussed one situation where an unlicensed shop manager was making decisions contrary to the advice of the licensed A&P—and the desires of the aircraft owner. Essentially, bullying the aircraft owner into an unneeded and unwanted engine overhaul. With the aircraft left in pieces, unflyable and removed from the hangar, the owner was put into a tight spot. Fortunately, a compassionate FAA Inspector came to the owner’s defense. Part of the problem was the non-technical and non-licensed shop manager making technical decisions—which is out of the ordinary, or at least historically it is. With a shortage of A&Ps, will this become an ugly trend and how will aircraft owners deal with it?

According to Busch, the problem with filling the A&P gap begins with how shops bill for work—using a time and materials approach—essentially fixing everything that they see to avoid future liability. This drives repairs, which may not need to be required (just yet). At the same time, A&P wages are much lower than other industries—typically at $30 per hour, with apprentices at much lower starting wages and shop rates as low as $80 per hour. A paradigm shift is required to sustain the industry. Busch explained that a minimalist maintenance model combined with fixed-rate billing (like an automobile shop) will have the impact of increasing salaries, while reducing an aircraft owner’s total cost of maintenance.

BEHIND THE SCENES

In the maintenance world, there are a handful of broad-brush categories: technical or wrenching skills and experience, project management, logistics management and parts procurement. There is also administration and talent management. When all the categories are in equilibrium and operating at high levels, quality customer service can usually be delivered to the customers—and it doesn’t take long for the small market to figure out which shops succeed and which ones fail.

MRO facilities can be vastly different depending on the business type. There are six types of MROs: independent FAA Repair Stations, FBOs, commercial airline hubs, regional airline facilities, military facilities and in-house corporate facilities. Most GA aircraft are serviced at independent repair stations or shops staffed with at least one A&P with IA (Inspection Authorization) credentials. These are typically small and operated by a handful of employees, but some can also be owned by large corporations. Some independent repair stations specialize in specific airframe makes and models. Aviation Unlimited in Toronto—a Piper, Diamond and Daher/Kodiak dealer—focuses on maintaining and repairing the airframes that they represent in Canada. While their mechanics can work on Cessnas, they typically turn that business away. This isn’t uncommon at other brand specialty shops in the U.S., Canada and beyond.

Balancing people, process and technology ensures that the MRO can deliver services to its GA customers in a timely and cost-efficient manner. I like to think that a well-run shop will have mature MRO-specific software to manage the shop. A quick Google search finds 55 such software products. Aviation maintenance software simplifies the constant repair operations of a MRO, monitoring parts inventory levels, supporting preventive and essential maintenance and repairs, scheduling work orders and tracking and documenting compliance. Aviation maintenance tracking software (or MRO software) helps organizations maximize their efficiency, letting them focus on their jobs and keep their facilities and aircraft running smoothly and safely. Long gone are the days of whiteboards and yellow Post-it notes.

MRO CONSOLIDATION, TRENDS

The pandemic has changed a lot of realities, beginning with access to talented and experienced resources. Some shop owners, looking more like me than my son, are thinking about retirement. Interviewing a small shop in the Eastern U.S., the owner is 77 years old and has been thinking about retirement. Financially, he doesn’t see a return on his assets, which are nominal, but it has taken decades to build up the spare parts inventory and tools. Psychologically, he prefers not to think about the end of the runway, but is waiting for an event (like losing his medical) to trigger retirement.

According to Boeing’s Pilot and Technician Outlook 2022-2041, the industry will need as many as 610,000 new A&Ps over the next 20 years. That’s not counting techs who can troubleshoot and install avionics and electronic systems.

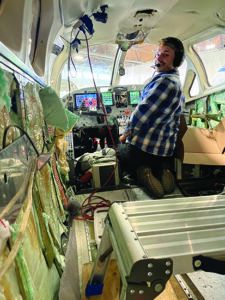

Some MROs, which have focused on airframe and powerplant, have decided to expand their operations into the avionics, paint or interior side of the business. New School Maintenance made that decision in 2020 and acquired test equipment—a huge investment—but after more than three years, has been hard-pressed to find talented and certified avionics technicians. Perhaps that’s a function of compensation. Meanwhile, the company has invested capital with no revenue. Other MROs use acquisition as a method to expand their service offerings.

Some MROs are considering buying their competitors at airports near their own base of operation. Essentially, this allows the acquiring MRO to consolidate their existing back-end administrative personnel, MRO software systems and specialized hardware. Consolidation jump-starts the hiring and customer acquisition process. With most regional GA-focused MRO shops being small, consolidation might be a natural outcome as the founding owners retire. I’m curious when larger companies like Boeing jump on the consolidation bandwagon, buying up regional MRO shops, akin to the FBO acquisitions we’ve seen over the past few years.

THE MRO’S PERSPECTIVE

The MRO’s (I’ll use the MRO term loosely to include folks working out of their pickup truck) challenge is managing time, constrained resources and customer expectations. The time and cost investment to certify an apprentice can take two years. Some shops throw the apprentice into the deep end, but ultimately, the licensed A&P must devote time to supervise the apprentice. This adds costs to the job, but it’s a way of life at the majority of shops.

Blaine Field, president of Brant Aero, an airframe, powerplant and avionics shop located in the Greater Toronto area, reports: “At the beginning of the pandemic, and again last summer when interest rates began to rise and the war in Ukraine ramped up, I had an expectation that business would slow down. Surprisingly that did not happen. In fact, as Garmin and other avionics manufacturers have caught up with their supply chain challenges, a floodgate of work has been released, and we’re seeing a 10 percent growth in our Q2 2023 revenue. While we run a lean shop, we’ve hired five apprentices in the last four months, with an expectation of investing into their two-year path to licensing and our future growth.”

Brant Aero has 32 employees with an average tenure of 12 years. They have more than 18 staff members, each with more than eight years of service. Brant Aero’s leadership’s approach to attracting and retaining talent focuses on creating a culture that respects the staff, delivered in a family-orientated environment with good pay and benefits. They migrated their operations to a four-day, 10-hour workweek, giving the staff three days off. To manage five days’ coverage, they have a Monday to Thursday and Tuesday to Friday shift that rotates every four weeks. This provides a four-day weekend every other month in addition to statutory holidays. When not working in the demanding shop environment, this time off is important for the quality and efficiency of the workflow. The culture focuses on balancing customers’ needs, but not running the staff too hard (and incurring overtime, reducing overall profitability and job satisfaction).

Talent acquisition and retention is challenging for MROs focused on the GA and BA sector. Airline and regional operator A&Ps work in an environment completely different than the GA/BA environment. As an example, access to aircraft technical information on computers while at the aircraft is not typical to this environment. Categorization of A&P staff based upon MRO category exacerbates the challenges for the GA and BA MROs, as the labor pool shrinks.

How the A&P industry will react with the changing dynamics is tough to say. Consider that in 2020, there were 3133 aircraft MRO shops in the U.S. (estimated at 3559 in 2022). The number of freelance A&Ps working out of the owner’s hangar is hard to quantify, as is the average age of these folks. Worldwide, in 2022 there were 3630 new aircraft and rotorcraft manufactured and shipped. AOPA has estimated the 2021 GA fleet at 204,405 aircraft.

WHAT’S AN OWNER TO DO?

In an environment of supply chain constraints and labor shortages, picking your maintenance shop (for new owners) is critical to the timely delivery of products and services. For existing owners with a pre-existing relationship a few red flags should not be ignored. With the MRO system stretched past normal capacity, burning bridges caused by quality or customer service issues generally isn’t a good long-term strategy. From the owner’s perspective, being seen as part of the solution rather than part of the problem will go a long way in keeping the relationship on solid ground.

For new owners looking for an MRO, talk to other owners and solicit shop recommendations. Historically, we looked at technical expertise, attention to detail, cost and customer service. In the post-pandemic paradigm, we now must do a deeper dive. Consider the number of apprentices, the number of licensed A&Ps, the amount of available automation (versus paper systems), project management, logistics and procurement staff, plus the experience of the MRO’s management. Keep close tabs on the shop that did your last annual inspection when the shop changes hands. They may be predisposed to continue the relationship (this works if the new owner is local to the old owner). The trick is to ensure that the conversation is inquisitive and non-threatening, as opposed to a Jack Webb Dragnet style of chat. Rule number one: Don’t get sideways with the folks who wrench your aircraft.

With access to shop resources becoming a scare commodity, you might consider booking your next annual right after the last annual was completed. With one year out, you should be assured a hangar spot. Checking back with the shop three months before the annual is due ensures that your aircraft’s booking slot hasn’t fallen between the cracks (and gives you some time to make alternate arrangements). Discussing any proactive maintenance requirements in advance will allow the shop to preorder the parts, minimizing delays.

Attention to critical events at your shop or MRO is critical to ensure access to maintenance resources. Evaluate some critical areas of concern. Has there been a change in key personnel (director of maintenance, owners and lead A&Ps)? Is there a revolving door of A&Ps through the shop? Are the new owners qualified to operate the day-to-day tasks of the shop or MRO? Are scheduling times extending a few months into the future (even for simple things likes oil changes)? Are the shop’s owners talented business people? Oftentimes they are not, even though they are exceptionally good technicians. Essentially, you want to keep your fingers on the pulse of the MRO’s business. Listen to the shop’s other customers to get a feel as to the shop’s profitability and its ability to attract new talent.

CONCLUSIONS

Managing maintenance shops during changing times is very much an exercise in psychology, salesmanship and making wise decisions. As aircraft owners, our goal is to minimize downtime and receive quality services, while paying the right price for maintenance. Navigating this new course will be a balancing act between managing old relationships while forging new ones. Consider investing some time into looking at new shops, essentially creating a Plan B, so that in the event of rapid changes, your aircraft is not left out in the cold.