While companies are defined by what they make, what they decide not to make can be just as distinguishing as the product catalog. And that would be the case with Rotax, the Austrian engine giant that all but owns the light-sport engine market. But a decade ago, flush with success, Rotax drew back from an expensive project to take on Lycoming and Continental with its own six-cylinder engine.

On a recent visit to Rotax’s Gunskirchen, Austria, factory, when I asked why it bailed on the big engine, the guarded answer was to the effect that Rotax is a company that knows what it’s good at and building high-horsepower engines isn’t it, at least not yet. The market wasn’t ready for a new competitor.

Through a combination of happenstance, geography and savvy marketing, Rotax has positioned itself in a market segment in which Lycoming and Continental have a presence, but not much developmental energy: the low-horsepower, four-cylinder segment. That it understands how to build such engines perhaps better than any other company is evidenced by the fact the company’s aviation division is a tiny appendage on a giant factory that builds a dizzying variety of recreational engines for the marine, ATC, motorcycle and snow machine markets. A lot of engines. The factory builds more than 215,000 engines a year, 35 times the combined output of Lycoming and Continental. But only about 3000 to 4000 of those are aircraft engines. As a result, it is a far different business than its U.S.-based competitors, which are legacy companies whose survival depends on careful, targeted reinvestment as described in the February 2015 Aviation Consumer profile of Lycoming.

Accidental Aviation

Rotax’s Gunskirchen factory is located in an industrial corner of Austria noted for steelmaking, but also for KTM’s modern motorcycle factory and Steyr, which builds diesel engines in a town of the same name. Like Lycoming, which once built bicycles and sewing machines, Rotax has bicycles in its history, too. Its very name is derived from rotating axle, a free-wheeling hub for a powered bicycle it manufactured a century ago. An example lives in a glass case in the company lobby, overshadowed by the cutting-edge motorcycle and snow machine engines Rotax makes today.

And snow machines are how Rotax got into the aircraft business. In the late 1970s, as snowmobiling was taking off, Rotax, then owned by Bombardier, whose founder, Canadian Joseph-Armand Bombardier, essentially invented the archetype, had a brisk two-cycle snowmobile engine business in hand. But they noticed something curious. Many more of these engines were being shipped to North America than forecast replacement cycles suggested. A little sleuthing revealed that Rotax snowmobile engines were being adapted to power ultralight aircraft, a trend that eventually morphed into the Rotax 447, the 503 and the 582, all two-stroke, geared aircraft engines, many of which are still flying.

Although the North American ultralight market proved short legged, Europe was another matter entirely and Rotax could see that the industry was on the verge of developing a swarm of light aircraft that were more like real airplanes than the rag-and-tube kites most of us think of as U.S.-style ultralights.

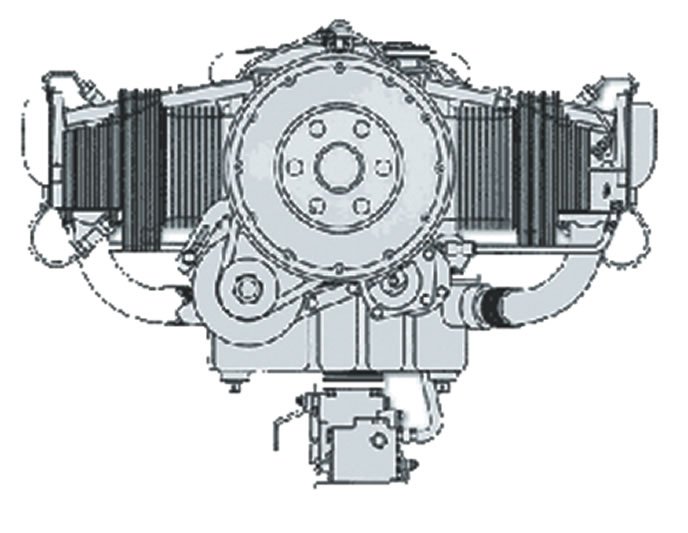

That meant a market for higher horsepower, lightweight engines and thus was born the four-cylinder Rotax that has evolved into the 900-series engines that dominate the light sport segment and that also own a respectable piece of the experimental market. When I was in Austria last summer, Rotax was celebrating 25 years of producing these engines and they threw a big party for the 50,000th four-cylinder to come off the assembly line, a 912 iS with fuel injection and electronic ignition.

Different Strokes

When Rotax four cylinders first appeared in quantity in the U.S. in the Diamond Katana 20 years ago, they were the brunt of many a joke about chainsaws and snowmobiles, the fruit of a distinct exhaust note that isn’t anything like a Lycoming. The ultimate insult: They aren’t “real” aircraft engines. That was given some credence by the Katana’s lukewarm performance with the 80-HP 912; it yielded anemic climb in the lightweight Katana and had a reputation for cooling problems. Frustrated with Rotax, Diamond turned to Continental’s IO-240, a conventional aircraft engine that buyers and schools liked. But Rotax’s stumble was a North American thing; most of the 912-powered A1 Katanas were shipped to Europe, where they’re prized for fuel economy.

Rotax never looked back. It continued to build and develop the four-cylinder line, introducing the 100-HP version of the 912, the 115-HP 914 and, more recently, the 912 iS and iS Sport for the light sport and experi-mental markets. When asked if this development arc means larger four cylinders or even a resurrection of the six-cylinder in the future, Rotax’s Francois Tremblay, head of BRP Powertrain, was cagey. “We’re not a company that stands still, typically. We’re all about innovation,” he said.

Recreation as Business

There’s little doubt that Rotax has the resources to develop any engine that might find a ready market, nor does the company insist on swing-for-the-fences volume. Its entire aviation division produces about the same number of total engines (new and overhauled) that Lycoming and Continental do, but with an emphasis on new manufacture. Like every other aviation business, its business plan assumes small volume. It took two years to sell 500 of the expensively developed 912 iS and Christian Mundigler, the company’s chief aviation engineer, told me that in pitching the iS project to senior management, he envisioned at least a 20-year product cycle. Rotax’s long view of the market isn’t the only way it differs from companies plying the aviation universe in the U.S. Following its sideways entrance into the aircraft engine business, Bombardier CEO Jose Boisjoli was famously quoted as saying he didn’t understand much about aviation, but he clearly appreciated the passion of those involved in it. This may be the reason that the sign out front still says BRP Powertrain, for Bombardier Recreational Products and why Rotax considers itself a recreational engine company, not an aircraft or motorcycle engine company.

That’s more than just marketing piffle, for Rotax is rapidly responsive to the wishes of its customers, who are largely builders of gasoline-powered recreational toys, not airplanes, cars or trucks used in commerce. Although it retains Bombardier on the sign, Rotax is now an independent company, having been divested by Bombardier in 2003. But Bombardier happens to be Rotax’s largest single customer, so the two remain joined at the hip.

Bombardier’s considerable appetite for snowmobile, ATV and watercraft engines has built and sustained a state-of-the-art manufacturing facility, of which the tiny aviation division is a major benefactor.

While Lycoming and Continental subsist on demand for legacy aircraft engines and some new manufacture, Rotax is the reverse. It builds a variety of engines in all power ranges for motorcycles, ATVs and personal watercraft, both for itself and other companies. The BMW 800GT motorcycle I rode to the factory last summer had an engine built in Gunskirchen. When I toured the plant, I saw a production cart stacked with the very same vertical twin engine cases.

Rotax executives told me the company is able to leverage the high-volume recreational engine business to support both development and manufacture of aircraft engines. While Lycoming and Continental have invested carefully to upgrade their dated manufacturing capabilities, Rotax has latest-generation everything; there’s not a manually operated mill or lathe in sight. The factory is more vertically integrated than U.S. manufacturers tend to be. Although it does no primary foundry or forging, many specialized processes such as heat treating and surface treatments are done in house, both because the economics are better due to Rotax’s high volume and because the company believes they have better control of quality if they rely on fewer vendors. A tour of the factory floor reveals acres of automated CNC and some robotics operating without a human in sight.

After a fashion, Rotax even builds its own humans. Following the European tradition of apprenticeship, Rotax runs an in-house trade school from whence it hires the best graduates for its own factory. I was told that the company sees this as both an investment in its own interests and in the wider social good, since those apprentices are free to work elsewhere.

Click here to watch Rotax Video

Factory Within a Factory

Rotax occupies a complex of buildings on the Gunskirchen site, with the aircraft engines built in what’s known as Building 1, the original structure that housed the company when it moved there in 1947 from another site in Austria after having been in Germany before that. The main factory contains most of the parts-manufacturing capability and amidst the clatter and hum of machinery, two moving assembly lines turn out as many as 300 of the aforementioned recreational engines a day. From parts bins to an engine ready for a brief test run requires about 90 minutes, typically.

By contrast, the aircraft engine assembly area is as quiet as a library and probably smaller than most that might be found in a medium-sized city. Rotax follows the typical convention we’ve seen in other aircraft engine plants, notably Continental’s diesel engine works at St. Egidien, in the former East Germany. (See Aviation Consumer, August 2014.)

All of the engine plants we’ve visited use an assembly line of sorts and Rotax is no different. Engines are assembled from the inside out, starting with a crankshaft placed into the case, along with the camshaft. Subassemblies such as the oil filter bracket, the gearbox and clutch mechanisms and cylinders are built up on compact work benches surrounding the line, which is only about 30 feet long. The engines are passed along to several assemblers on a traveler rail system.

While the assemblers on the mass production side are journeyman workers, only the elite work in the aviation division. “Only the best can work here. Everyone wants to work on the aircraft side,” Mundigler told me. The assembly work is far from rote; it requires the skill to measure, analyze and use discrete tools and processes. Rotax recognizes this and gives the aircraft assembly staff one 10-minute break per hour, while in the main factory, it’s three breaks per day.

For quality control and traceability in assembly, Rotax uses two methods: computer monitoring and so-called four eyes. A program called Filemaker stores a virtual engine as a master.

“We build the engine in reality and in the Filemaker system,” Mundigler explained. “When he is ready and he hands the engine to the next guy, he has to check off to see everything is done.” The file stores the primary torques and tightening sequences and traces every part installed. That data lives with the serial number for the life of the engine. For those processes that the computer can’t track through tool monitoring, a second assembler claps eyes on the work and checks it—the “four-eyes” method. In addition, incoming parts are subject to inspection, some at 100 percent, such as pistons, and some through statistical process control.

After final dressing, the aircraft engines are shipped off to the test cells for trials. They’re run for 50 to 90 minutes, depending on the model and whether the engine is certified or not. The major bottleneck in production is obviously the test cells, even in the low-volume aviation side. If a dozen engines trickle off the line a day, the cells have to run multiple shifts to keep up. On the mass assembly side, the engines run for just a few minutes. Nonetheless, the factory burns more than 1000 gallons of gas a day just testing engines—seven days a week. It recovers that otherwise lost energy to produce nearly half of the plant’s electricity. Lycoming, by the way, is also practicing heat and energy recovery. In the competitive world of modern manufacturing, they don’t exactly have a choice.

Rotax Future

Two-and-half years ago, Rotax surprised us with the introduction of the 912 iS, which represented a significant investment in what’s hardly a bull market. That leads us to believe Rotax has something up its sleeve developmentally. “When you look at the future, people want more power. The industry is going toward four-seaters. So that’s something we’re looking into now, what should be our next level? We’re looking at various options,” said Francois Tremblay. It’s easy enough to see the marketspace, if not to pencil out a business case. A 160-HP four-cylinder that weighs 75 pounds less than a Lycoming IO-320 or -360 might just find a niche. But to do that, Rotax might have to overcome whatever demons kept it from launching that V-6 a dozen years ago. Then again, it didn’t notch out more than seven million engines by being too afraid of failure.