If economic recovery requires the restoration of confidence, we have a suggestion: Just bottle up the bounding confidence that the developers of aerodiesels have that Jet-A engines are the future and distribute it to the general population. Although the aerodiesel market has, at best, stumbled along looking for serious traction, the unswaying conviction of those in the diesel industry seems to be that Jet-A piston engines are an inevitability. According to our count, there are six active projects in the aerodiesel arena: Austro, Centurion (formerly Thielert), DeltaHawk, SMA, Gemini and Zoche. (Remember them?) Heres an update on each.

Car vs. Airplane

What we found most interesting about the current state of the aerodiesel market is that its four to two in favor of purpose-built aircraft engines rather than engines adapted from the auto segment. The automotive crossovers are Austro and Centurion, both of which are adapted from widely successful Mercedes Benz automotive diesels. SMA, DeltaHawk, Gemini and Zoche are all clean-sheet designs developed specifically for aircraft.

Thus far, the only remotely successful aerodiesel is the Thielert (now Centurion) 1.7 and 2.0 liter diesel series which Diamond enabled by adopting it for the DA42 Twin Star and the DA40 TDI.

And if remotely successful isn’t the right term, perhaps elusive is the better word. Diamond owners encountered show-stopping maintenance and economic issues with the Thielert engines which led in part to Thielert falling into bankruptcy last spring. Fed up with dealing with outside engine suppliers, Diamond formed Austro on its own and just completed certification of its own aerodiesel loosely based on the MB 2.0 liter Centurion is now using. (See the March 2009 Aviation Consumer for a full report.) With hundreds of Thielert engines still in the field in Diamond aircraft in various states of serviceability, we asked Centurion what its market outlook is.

Centurion

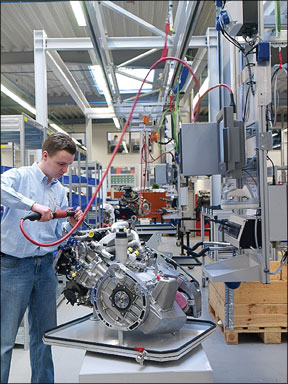

Earlier this year, Thielert changed its name to Centurion as part of a wider rebranding and retooling. Via e-mail from Centurion, we were told that the company is no longer relying on funds from the German government. Further, the company said it never stopped manufacturing engines and is shipping both new engines and parts, with limited warranty of two years.

Further, said Jasper Wolffson, Centurions new CEO, the company is continuing R&D, with improvements in the control service unit and a completely redesigned clutch and gearbox to extend service life to 600 hours. These new components are expected to be available later in 2009. (Currently, the gearboxes and clutches have to be removed and inspected at 300-hour intervals.)

Wolffson said via e-mail that Centurion believes it has a robust future market with stable demand in the retrofit market, where Austros new AE300 appears not be a player yet. Given that it has an installed base of more than 2000 engines-many in Diamond aircraft-Centurion believes the cost of converting those to Austro engines will be too great and that it will continue to own that market. Austro

contests that point.

SMA

If there’s a second established contender in the aerodiesel world, it would be the French-based SMA. Like Thielert, SMA was out of the gate early (2002) with its four-cylinder, four-cycle purpose-designed aeroengine, the 230-HP SR305. But unlike Thielert, the SMA engine hasnt found a major OEM. Cirrus looked at the engine and even announced a model that would have it, but it found the powerplant to be too heavy and too unreliable in cold weather. It has since shelved the project. Maule still offers its SMA-powered M-9, but the company didnt return our calls for feedback on the project.

There are STCs for converting the Cessna 182 to the SR305 and a handful of them are flying. But Nu Tech, a Canadian company that does the conversions, told us that the market has recently been quiet, either due to the general economy or worries about the engine itself. Nu Techs Dennis Major told us his company has participated in cold weather testing and improvements for the SMA diesel and that he thinks cold weather ops are no longer an issue if you treat the diesel like a gasoline engine by plugging it into a pre-heater when the temperature drops.

Majors fleet leader Cessna 182 SR305 has accumulated 400 hours with what he describes as acceptable service history. He believes it can deliver on a 2000-hour TBO with little more than piston changes. Other diesel developers are similarly confident about high TBOs, but only Centurion has significant operational experience and high TBO numbers don’t come to mind when describing those engines. Does this lackluster durability confirm the suspicion that automotive engines simply cant be adapted successfully to aircraft? Three other diesel makers think so.

DeltaHawk

One of the Centurions mechanical weak links has been the gearbox and clutch assembly, which require frequent replacement. So when Delta-Hawk set out to develop its aerodiesel, it avoided that problem altogether by designing an engine that doesnt need one. The DeltaHawk diesel is direct drive to the prop.

The DeltaHawk project hasnt been around since the dawn of time, it just seems that way. The company began work in 1997, funded entirely by a trickle of capital from its ownership group. That, more than anything, has stunted the engines rapid

development, says DeltaHawks Rip Edmundson. “We were nave about what it takes to develop a new engine,” he told us. The project has been in the works so long, in fact, that technology has evolved since its inception. For example, it initially started with mechanical fuel injection, but electronic injection has improved to the point that DeltaHawk may consider it if developmental funds are available. For a purpose-built aerodiesel, DeltaHawk pursued what it thought was the only logical design: a two-cycle, turbocharged water-cooled four-cylinder engine. Three horsepower ranges are envisioned: 160, 180 and 200 HP, but larger output engines are under consideration.

Two-cycle diesels have three advantages over four-cycle designs like the Centurion and SMA. They have fewer moving parts, theyre lighter and because the power pulses come once per revolution rather than every other revolution, the diesels characteristic high-amplitude vibration is tamed somewhat, so the DeltaHawk can run a metal prop where the Centurions cant. On the negative side, two-cycle diesels need a mechanical supercharger, because they cant self-scavenge for starting. That adds a degree of complexity and gives back some of the weight advantage, as does its liquid cooling.

The DeltaHawk is a V-4 configuration and because its a dry sump design, it can be mounted with the V up or down. It weighs about 380 pounds fully dressed, which is about 15 pounds heavier than an equivalent Lycoming O-360. (The SMA, by comparison, weighs 429 pounds.) The engine is significantly narrower and shorter than the Lycoming, but raises the prop centerline four inches if its mounted inverted. Thus far, DeltaHawk has accumulated many hours of test running and the engine has flown extensively in Velocity experimentals, posting fuel specifics of about .39 lb/hp/hr-better than most gasoline engines, but about equal to the most efficient large-inch Continentals.

The DeltaHawk doesnt have a market-based service history yet, but Edmundson told us what experience it has accumulated has revealed typical diesel birthing pains: excessive oil consumption and vibration-related breakages. With each new iteration of the engine, he said, these issues are being fixed.

Where to from here? DeltaHawk has about 22 engines in the field being examined and tested by various companies. Since it plans to certify the engine to FAR 33 standards, it has submitted a proposed cert program to the FAA, which has been approved. Its working on developing a conforming parts system, too. Going forward, DeltaHawk believes its best market shot is OEM conversions of equivalent horsepower airframes, such as the Cessna 172, the Piper PA-28 series and possibly some Mooneys. Its aiming for an initial TBO of 2000 hours at purchase and

overhaul costs similar to an equivalent new gasoline engine.

Gemini

Swept in with the flood of new LSAs at AirVenture last year was a proposed new diesel engine for that class of aircraft. Like the DeltaHawk, the Gemini 100 is a clean sheet aircraft engine, but the sheet has some faint markings on it dating back to between-the-wars Germany, when the famed Junkers 205 found both a civil and a military market. The 205 is often claimed to be the only commercially successful aerodiesel and given the wreckage of more contemporary efforts, arguing the point may be a dark hole. But the Gemini is really a modernized version of the Jumo.

Like the DeltaHawk, the Gemini is two-cycle diesel, similarly mechanically supercharged and (optionally) turbocharged for an additional 25 HP. Its also liquid cooled. But the similarity ends there. The Gemini has three cylinders, each with two pistons operating horizontally opposed and drawing power from the same combustion pulse. (See the drawing on page 21.)

It has two crankshafts mounted where the valve gear of a conventional engine would be and these join through an idler gear to output to a prop shaft. The engine runs at 4000 RPM and is geared down 1:6 to 1 to prop RPM. Each cylinder has a single injector thats electronically managed through a high-pressure common rail system, similar to the Bosch system, according to Tim Archer, whos working with the UK-based Powerplant Developments to bring the Gemini to market.

Archer said the engines installed weight is expected to be about 191 pounds for the 100-HP variant. According to Powerplants Web site, the engine can be scaled to six cylinders and 360 HP. The World War II variants produced as much as 867 HP for a power-to-weight ratio of .66 HP/LB. The Jumo didnt live on beyond World War II, but the British adapted its basic design as a light, powerful marine engine.

Archer told us that a developmental version of the Gemini has been running in a test cell, but hasnt been flown yet. Tests are planned for later this year by Tecnam, an LSA manufacturer. Given that Powerplant hasnt found all the investment money it needs yet, the project may be as underfunded as DeltaHawk is.

Even at that, however, it does have a couple of advantages over its competition.

First, if there’s demand for an LSA diesel, the Gemini is the only offering in that horsepower range. Second, the engine will initially be an ASTM engine, not a FAR 33 engine, which greatly simplifies bringing it to production and allows Powerplant to acquire service experience before attempting wider marketing and certification. Further, the company appears to be thinking about markets outside aviation, which we think is a smart idea, given the volatility of aircraft demand. Archer said Powerplant is aiming for a product to release into the experimental market as soon as 2010.

Analysis

The oddity is that despite all the confidence and even Thielert/Centurions claim of 2000 engines flying, the diesel market remains unproven. Or, more perversely, as one of the sources we talked to said, “Thielert did prove the market. They proved that you cant succeed with a converted car engine.”

But its not done there, of course. Centurion is retooling and trying to make a go of it based on its installed base and new conversions. But in our view, if they cant produce an engine that doesnt need gear box removal every 600 hours and someone else does-namely, Austro-theyll be at a serious disadvantage.

And since Austros plans-never mind the durability of its engine-remain unknown, Centurion could be vulnerable if Austro decides to go after retrofits and conversions. These two companies will be slugging it out as the dominant diesel makers for the next two years.

What of SMA? This project is looking ever less likely to succeed, in our estimation. There’s no meaningful OEM interest in it and not many conversions flying. Despite numerous attempts, SMA was utterly unresponsive to requests for its view of the market.

We like the two-cycle diesel idea being advanced by DeltaHawk and Gemini. Both projects are, at the moment, underfunded, but it wouldnt surprise us to see a major player like Lycoming or Continental sniff around either one of these designs. If the diesel true believers are right, both companies will eventually have to get into Jet-A piston engines. The question is, which one and when?