When we looked at the market for replacement interior plastic components nearly five years ago, prices were inordinately expensive. But recent research (including visits to several suppliers) proved that prices are falling and it’s easier than ever to get high-quality replacements for worn and broken plastic parts.

The reason for the shift is partly because suppliers are earning more FAA PMAs (parts manufacturer approval), while pricing is based more on actual cost rather than inflated OEM pricing. But shopping for replacement plastic—especially for an aging interior—can be a complicated task. Here’s what to expect and how you might choose a supplier.

A Hard Life

The common thread in the aftermarket plastic business is the dwindling OEM support for replacement plastic parts for legacy aircraft. One exception is Piper, which has made an effort to get tooling to aftermarket shops for proprietary parts manufacturing. And since these airplanes are still active, that’s good news for the aftermarket suppliers and for competition.

Thanks to the handful of companies doing this, there are plenty of available replacement parts. Moreover, all of the companies we researched focus on building the parts that are most prone to breakage and unusual wear and those that get replaced most often. Yes, aircraft plastic lives a hard life and a quick look around your own aircraft—inside and out—will reveal problem components.

Plastic has been used by OEMs for interior and exterior components for decades because of its cost, weight and ease of fabrication. Fiberglass gained popularity as some parts are intended to handle structural/aerodynamic loads. Jim Bede used fiberglass for wing root and tips to compensate for passenger weight, and because he saw Cessna and Piper wingtips getting trashed by hitting airport fences and other ground obstacles.

The problem with all plastic parts—interior and exterior—is they eventually become brittle due to UV light. Some older plastics used in legacy aircraft have the consistency of tortilla chips and some had been pulled so thin in forming that you could almost read through them. Others just wear out naturally or by human handling.

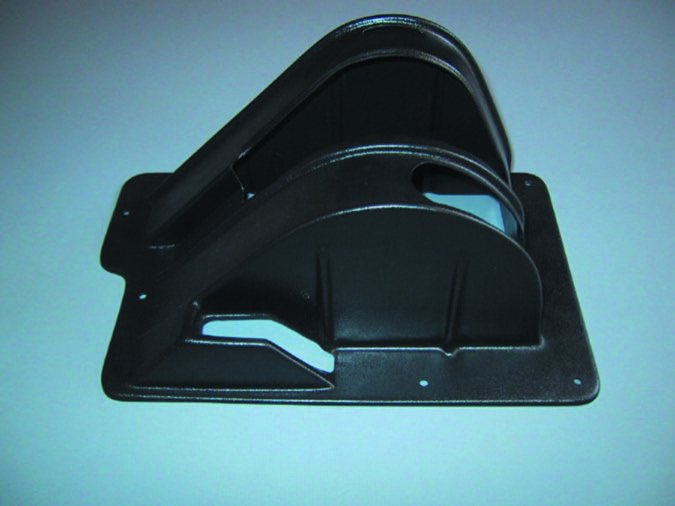

Elevator tips, window trims, door panels and plastic parts that need to be removed for annual inspections might live the hardest lives, while others wear prematurely because they are prone to vibration. Parts that stick out might get hurt the most, and landing legs and fairings take a beating. Luckily, plastic parts can be repaired and some damage can be hidden, but eventually you run out of washers big enough to hide cracked or oversized holes. There’s no set lifespan for a given piece of aircraft plastic, but in general about every 20 years or so most plastic has degraded enough to require replacement. On the other hand, we’ve seen 40-year-old aircraft with original plastic components that look they just rolled off the factory floor. For preserving interior plastic, using cabin sun shields and covers is a huge help.

So while many plastic components aren’t structural by design, can you remove and still operate the aircraft without them, as many do when a broken plastic part breaks? Legally speaking, not always. Every certified aircraft has a type certificate data sheet and if a part is installed on the airplane when this sheet is generated, then legally that part has to be on the airplane. Does it make a difference aerodynamically or with regard to safety? Not always.

A missing upper strut fairing isn’t going to hurt much, but it does open the attaching hardware to the elements and contact, plus it was likely on the aircraft during its final certification. Sure, there is nothing in the regs about how the parts look cosmetically, so some field repairs and touching up is perfectly legal. Break out the epoxy. Replacing plastic parts that are non-structural and that do not require the disassembly of a critical or structural component is perfectly legal under the approved owner maintenance list prescribed by the FAA, as long as simple requirements are met. Do the research before getting involved in the repair.

A Crowded and Competitve Field

There are over a half-dozen major suppliers of aircraft plastic components (some specialize in interior parts), and that doesn’t include the smaller shops that dabble in specialty plastic parts and mods. When you do a web search for airplane parts—interior or exterior—prepare for a lot of comparison shopping. It’s an interesting and competitive industry.

From our experience, most of the competition know one another and have worked together at some point. Competition is keen, though, and the major players have spent years and millions of dollars to build manufacturing capabilities, earn PMA approvals and in our sense try hard to offer parts at reasonable costs, compared to OEM offerings. In reality, from a quality and price standpoint, they are actually the best watchdogs for the industry.

As mentioned earlier, the pricing structure of plastic parts is not always based on how much plastic is in the part or, as was the case decades ago, what the OEM charged for the part. The aftermarket companies have (based on our research) developed pricing structures that reflect the actual development and manufacturing costs for a part, and tossed in the certification costs based on a potential number of unit sales anticipated. This benefits the customer to no end.

A couple of the businesses we visited build parts for the OEMs using their proprietary tooling and materials, and just looking at the tooling would explain why OEM prices are so high. It is quite well-engineered and built for a long life. How? Some molds are cast aluminum and most are a mix of resins that stabilize over time. Describing them as heavy is an understatement. The shops that use OEM tooling are forbidden by contract to use the tooling to make parts they sell to the aftermarket. On the other hand, if you consider that most aftermarket parts tools are made from OEM parts, suppliers certainly have access to accurate parts that they can reverse engineer. There are also a number of tools that have been purchased from the OEMs. When the decision is made to cease supporting a certain part, they sell the molds. This works for the OEM, the customer with a legacy plane and the shop. It also virtually guarantees the exact fit of the parts.

From a materials standpoint, the new plastic part has to be made of the latest fire-rated materials available, which has been the case since the 1990s. Most parts are pulled from .090 ABS plastic and some, as required by the original aircraft type certificate, Kydex, which has enhanced fabrication qualities and flame retardancy.

Sourcing Your Parts

There are essentially seven major players in the replacement plastic parts business, including Vantage Plane Plastics (www.planeplastics.com), Knots 2U (www.knots2u.net), Texas Aeroplastics (www.buyplaneparts.com), Premier Aerospace Services and Technology or P.A.S.T. (www.premieraerostore.com), Plane Parts Company (www.planeparts.com), Stene Aviation (www.steneaviation.com) and Mapleleaf (www.aircraftspeedmods.ca). In our prior research we found two more, but Globe Fiberglass was purchased by Knots 2U, while Heinol and Company was purchased by P.A.S.T.

We found that Vantage Plane Plastics has the largest inventory. It is part of Vantage Associates, a California aerospace conglomerate that does vacuum forming, among other things, and the general aviation division is in Alva, Oklahoma. Plane Plastics was once Kinzie Industries, a small company that built parts for Schweitzer Helicopters. When the company purchased a Cessna that needed replacement plastic it built it and eventually began pursuing this business. The plastic forming portion of the business was sold to Vantage Inc., which changed the name to Plane Plastics. The company houses over 4000 tools, has over 3000 PMAs and the company builds a number of parts for Cessna.

Dale Logsden hosted us on a visit to the huge Plane Plastics facility and admitted that the company had fitment problems in its early days. A longtime pilot and mechanic, Logsdon explained that originally the management was more interested in having the largest catalog and put more effort into finding parts to use as models for tooling than ensuring proper fit. Eventually it realized that once you build a part, it needed to be trial fitted, modified, rebuilt and trial fitted again until it was right. Toward the end of the Kinzie reign, this practice was started and has continued through the Vantage years.

Building a plastics tool is no easy chore. We watched the tool guys at Plane Plastics for a while and can attest that it’s time-consuming work. Some of the tooling can weigh we’ll over a thousand pounds. The build process has to allow for thinning of the material as it is stretched over the tool, plus the shrinkage that comes as the newly formed part cools. (Science 101: Things expand when heated and shrink when they cool.) Plane Plastics and most of the other shops use new materials that have minimal if any shrinkage over time.

Over the last few years, Plane Plastics reduced the price on most of its parts. We were told that it took a good look at aftermarket plastic parts throughout the industry and realized they were just too expensive. Having based their prices on the old Kinzie catalog, they reviewed the actual production costs and re-priced the parts accordingly. This price reduction—and a continued effort to ensure quality and fit—makes Plane Plastics perhaps a volume leader that focuses on one-stop shopping. It sells parts, materials and paint, plus it offers cabin noise reduction kits and carpeting.

Across town is Premier Aerospace Services and Technology Inc. or P.A.S.T. Scott Brown is the president and co-owner of this youngest of plastics companies. Brown and his colleague, Bryan Powers, originally worked with Kinzie, then Plane Parts, and finally started off on their own to focus on OEM contracting. They did this for a while before expanding to build their own PMA parts. P.A.S.T. purchased Heinol and Company, which built parts for Piper. Al Heinol honed skills in the auto industry and was responsible for submitting nearly all of the Heinol parts for FAA certification. The company still does contract work for Cessna and Cirrus.

P.A.S.T. gets by with just a handful of workers. We saw its large vacuum tables that make parts from full sheets, and a small table to save time and space and for low-volume parts. Being efficient with raw materials is an important aspect of its pricing structure. The company tries to keep a six-month supply of parts in stock. Brown told us the goal is to certify 10 new parts per month, adding to its already impressive inventory. In our research we found that its parts quality and pricing structure is right in line with other shops.

Knots 2U, Plane Parts, Texas Aeroplastics

For years, Wisconsin-based Knots 2U was known as a high-quality speed mods shop. When the company was sold to John Bailey, he realized that if the company was to grow it had to expand its business. Since it already made PMA mod parts for a number of Piper models and some Cessnas, Bailey began to make and certify some of the more popular replacement parts needed by Cessnas and Pipers and eventually added other brands. The company created a catalog, fattened the inventory and as business increased, it began buying smaller companies (including Metco for stainless steel cowl fittings), plus a door seal company.

Bailey told us that between its own development and the purchase of other companies it has allowed for nearly 50 new PMA approvals every year, and there were 30 in progress as we prepared this report.

Worth mentioning is that Knots 2U is fortunate in being close to a big city ACO (Chicago), which also has a track record for setting records in approving PMA applications. Still, in our experience the company is diligent in sustaining a high standard of manufacturing, materials, workmanship and fit. Bailey’s own parts are just a portion of the catalog, but with the purchase of Globe Fiberglass, plus herculean efforts to redo the tooling for reduced weight and better fit, his own brand of composite parts is of unquestionable quality, in our view.

Roanoke, Texas-based Texas Aeroplastics has been around since 1981 and has an extensive inventory of Cessna and Piper replacement ABS plastic parts, which are thicker and generally more durable than many OEM components. For a fee, the company will paint exterior pieces to match your current paint work—something to consider when replacing any plastic part. The company provides parts for Beech, Grumman, Cirrus and Rockwell airplanes, as we’ll as many Van’s RV models.

All parts for certified aircraft are FAA PMA approved, plus the company keeps a good inventory and is ready to ship same day. Its prices have remained the same over the past few years. Texas Aeroplastics employs only six people and is in the process of moving to a large, off-airport facility.

Los Angeles, California-based Plane Parts Company specializes in Piper interior plastic parts. Owned and run by Bob Adkins and his wife, the company was started in 1992 after Adkins needed replacement plastic parts for his own Piper Cherokee. He was appalled by the prices he paid.

Plane Parts is different from the competition in that it subcontracts manufacturing to a local company that uses CNC technology to make and trim the parts. The company focuses on selling parts that suffer the most attrition and has a bit over 100 PMA’d parts in its catalog.

Plane Parts can ship many parts the same day if the order is in early enough. Atkins told us that the return rate on parts has been less than 1 percent in over 25 years of doing business and the pricing has remained stable for quite a while now. Some (but not all) of the parts are pre-drilled or dimpled because many OEM parts that had holes or dimples did not match the structure. He tells us that very few Piper original parts actually have precisely jigged holes and that all OEMs’ window and upholstery trim pieces are installed individually as they went down the line.

Installing them yourself? His suggestion is to use a #4 stainless steel truss head screw and a nylon washer and simply shoot through the plastic into the flange, careful to avoid structure, electrical wiring and static system plumbing. It isn’t necessary to pre-drill the piece because according to him, the new plastic will not crack.

From what we saw, the engineering and attention to detail is evident in the product’s fit. None of the parts are copied from damaged or new surplus ones due to the shrinkage of plastic over the years. It uses newly manufactured parts as templates and test fits them to multiple aircraft. If necessary, the new part is refined until an exact fit is accomplished before building the tooling. While the company’s pre-drilled and trimmed parts might seem higher priced than others, there’s a definite value in installation time savings, in our view.

Stene Aviation in Polson, Montana, specializes in composite exterior Cessna parts. It has over 300 PMA’d components for Cessna models (the 150 through the 337) made from lightweight, flexible “E” glass material that conforms we’ll if there are dimensional vagaries. Stene recently received FAA approval on a line of parts for Piper models. Owner Will Stene told us the company will be rolling out composite landing gear doors and new nose bowls for Cessnas. It has worked closely with AeroLEDs to produce the Quasar LED CX wing-tips with integrated landing, taxi and recognition lighting.

Last is Mapleleaf Aviation in Canada, which specializes in fiberglass parts for Cessna models. We mention them mainly because their parts aren’t exactly like OEM parts—they’re modified and considered speed mods—so be sure there is an STC in place and the parts come with FAA paperwork.

The Future Looks Bright

An interesting development in the aftermarket plastic parts business is a handshake agreement between three of the major players to work together. There is nothing formal and they are not partners, per se, but Knots 2U, which is growing hand-over-foot and is thickening its catalog by the month, along with Texas Aeroplastics and P.A.S.T., have joined together to carry at least a portion of each other’s product line. This helps to create a one-stop shopping store. If one of them doesn’t carry the part needed, they will send the customer to one of the other companies.

They still compete, of course, and they still run their businesses independently and have different philosophies, but to see this kind of cooperation in the midst of competing and growing their own businesses gives a sort of neighborly feel to the industry.

From a tech standpoint, we’re glad to see these firms using more robust materials than the OEMs did. They understand the processes, shrinkage and the vagaries of vacuum forming. Better yet is lower prices and shorter lead times—proof that competition works for the buyer.

Price Shopping? CAVEAT EMPTOR

When it comes to pricing, we have found that the buyer needs to be aware of what he or she is getting. For example, if a part is available in plastic from one vendor and fiberglass from another, the fiberglass will be more expensive. In some cases, it is quite a bit more expensive, and in others not so much. It’s really the amount of labor that makes the difference, and of course, the fiberglass part will likely last a lot longer and should be considered if the part is a much used or abused item.

Considering that there are a kazillion parts out there for most all aircraft, a buyer can expect that different companies will make different parts and all prices come from God-knows-where, so a good deal of research time online or on the phone is in order. Doing an across-the-board comparison of all fabricators is difficult. We had fits doing so and finally gave up our search for a hands-down price winner. But specialty shops might seem to charge a premium.

When looking for interior parts, Plane Parts Company in California only does interior parts, manufactured using a CNC process. Based on our research, its prices averaged out to being a few dollars more per piece, but their promise of having a more accurate fit might be worth the extra money for some.

Along those same lines, you should understand that not all shops will have the same inventory. For example, Vantage Plane Plastics is big on interior parts and is in the process of expanding its exterior parts inventory and simply may not have what you need.

In an effort to get a true price comparison, we tried to choose some random parts that should be available for certain models, but found that this isn’t always the case. When you factor in that Knots 2U, P.A.S.T. and Texas Aero Plastics have combined to ensure that a customer gets a part, there is duplication of a number of parts in all three catalogs and in many cases, the prices are the same. For example, the later style overhead console for a Piper Archer is $242.54 from all three companies, and it’s likely that just one of them makes the component. This works for their catalogs and all three companies have gaps in their inventories that the others can probably fill, so in the end the customer really is taken care of.

This might help a buyer who’s sourcing a number of parts at the same time. He can determine which company has the most parts available and can price out all of them. If one company is more efficient—perhaps in infrastructure and labor— the total package would reflect a greater economy.

During our research we did find a number of random parts that were priced pretty close across the board. A lower strut fairing for a 1974 Cessna 172 is $66.05 at Vantage Plane Plastics, $72.91 at Texas Aero Plastics and $72.91 at P.A.S.T. The passenger door window trim for a 1980 Skylane is $138.27 at Vantage and $136.54 at Texas Aeroplastics, but wasn’t available from P.A.S.T.

Still, it pays to price shop. The center floor console for a 1975 Skylane was $213.94 at Vantage and $163.39 at Knots 2U. That kind of savings pays for the freight—and then some.